17 Worst Financial Crashes in History That Almost Broke the World

Money makes the world go ’round—until it doesn’t. The world saw crashes that–aside from shaking Wall Street–rattled the entire globe and left behind fear and panic. This article will give you a front-row seat to history’s most jaw-dropping financial wipeouts.

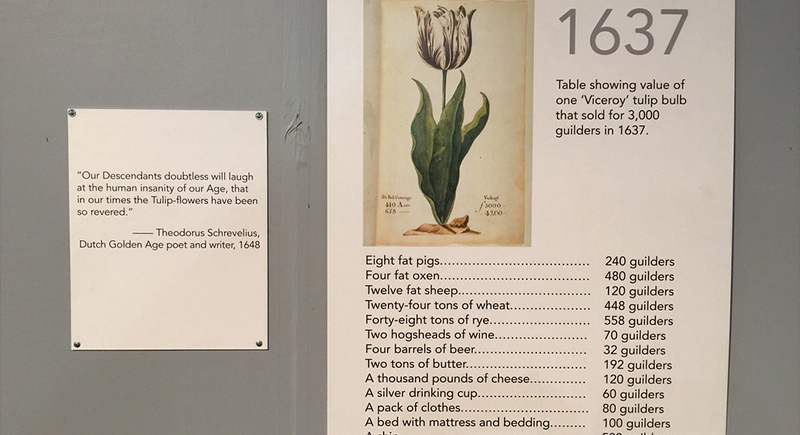

Tulip Mania (1637)

Credit: flickr

In 17th-century Holland, tulips became the ultimate status symbol, with some bulbs fetching prices equivalent to a craftsman’s annual salary. The craze peaked between December 1636 and February 1637, when prices for rare bulbs like the coveted Switzer surged twelvefold. However, by February 1637, the bubble burst as buyers defaulted on contracts and caused the market to collapse.

The South Sea Bubble (1720)

Credit: flickr

In 1720, Britain caught a severe case of money fever—thanks to the South Sea Company. It promised riches through trade with South America (which, fun fact, they barely had access to). Investors went wild. Even Isaac Newton lost a fortune.

Panic of 1792

Credit: MarketBulls

Wall Street faced its first financial panic in 1792. The speculative antics of financiers like William Duer sparked it. His risky moves to corner the U.S. debt market led to a 25% plunge in securities prices within two weeks. Treasury Secretary Alexander Hamilton quickly intervened by injecting liquidity into the system.

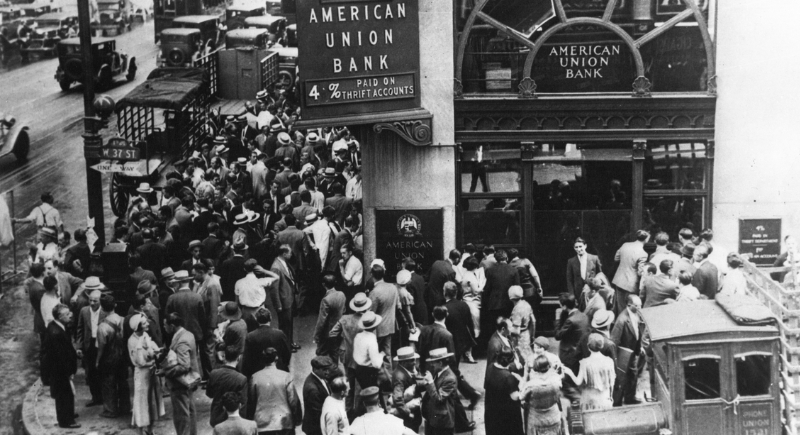

Wall Street Crash of 1929

Credit: Wikimedia Commons

The Wall Street Crash of 1929 hit like a piano falling from the sky. After a wild bull run in the Roaring Twenties, the market crumbled over just a few chaotic days in October, particularly on Black Tuesday, October 29. Stocks lost billions in value, banks folded, jobs vanished, and the beginning of the Great Depression occurred.

The Great Depression (1929–1939)

Credit: Wikimedia Commons

The Great Depression was a full-on economic nightmare that lasted an entire decade. Starting after the 1929 crash, it led to 25% unemployment in the U.S., widespread poverty, and even dust storms in the Midwest. Soup kitchens popped up on street corners, and many banks vanished. People even started sewing clothes out of flour sacks.

OPEC Oil Price Shock (1973)

Credit: Facebook

In 1973, oil turned from slick to shock when OPEC cut production and slapped an embargo on the U.S. Prices quadrupled almost overnight. Long gas lines, rationing, and “No Gas Today” signs became part of daily life. Strangely enough, this chaos also sparked interest in energy conservation, and those clunky compact cars suddenly didn’t look so bad.

Savings and Loan Crisis (1980s–1990s)

Credit: Youtube

During the 1980s and into the early ’90s, over 1,000 U.S. savings and loan institutions bit the dust thanks to bad loans, shady deals, and light-touch regulation. Taxpayers shouldered $132 billion out of the chaos. The mess dragged on for years and even helped inspire reforms.

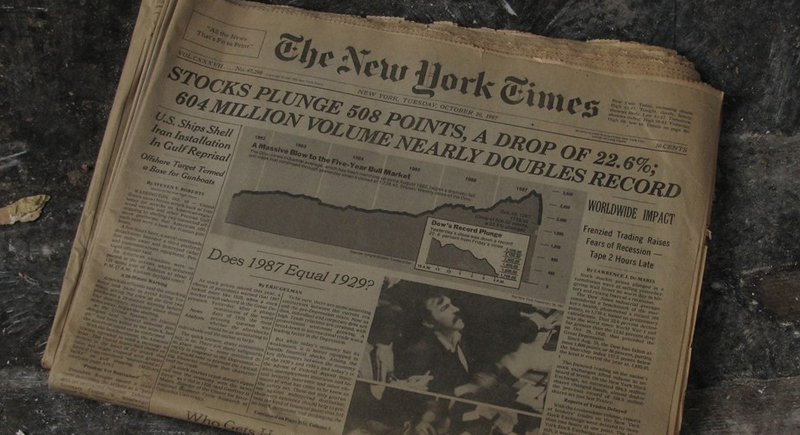

Black Monday (1987)

Credit: flickr

October 19, 1987—Black Monday—was the day global stock markets went into full meltdown mode. The Dow Jones plunged 22.6% in a single day, the most significant one-day percentage drop by index in U.S. history. The market bounced back surprisingly fast, but it still gave investors a serious case of financial whiplash.

Asian Financial Crisis (1997)

Credit: Wikimedia Commons

The Asian Financial Crisis began in Thailand in 1997 when the baht collapsed after the government ran out of foreign currency to support it. Panic spread fast across South Korea, Indonesia, and Malaysia. Thailand’s nickname for the crisis is “Tom Yum Goong Crisis,” after its famous spicy soup, which left the economy just as painfully hot and sour.

Russian Financial Crisis (1998)

Credit: X

In 1998, Russia’s economy went into a tailspin—debt piled up, the ruble collapsed, and the government defaulted on billions in bonds. Even salaries and pensions vanished for months. Surprisingly, Barter made a comeback—yes, some workers were literally paid in vodka. The chaos jolted global markets and reminded the world how fast things can fall apart.

Japanese Asset Price Bubble (1986–1991)

Credit: Wikimedia Commons

During the late ’80s, Japan looked unstoppable—real estate and stock prices soared, and Tokyo land was more expensive than entire countries. At one point, the Imperial Palace grounds were worth more than all the land in California, but the bubble burst hard by 1991. Japan slipped into a “Lost Decade” of economic stagnation.

Dot-com Bubble (2000)

Credit: Youtube

In the late ’90s, internet startups were the rockstars of Wall Street. If a company had “.com” in its name, investors threw cash at it—however, reality hit by 2000. The Nasdaq dropped nearly 80%, and big names like Pets.com vanished. The crash taught Silicon Valley a costly lesson in hype control.

Global Financial Crisis (2007–2008)

Credit: Reddit

The Global Financial Crisis hit like a wrecking ball in 2007, triggered by risky subprime mortgages and a whole lot of overconfidence. Banks bundled bad loans into fancy-sounding investments, and the entire system cracked when homeowners defaulted. Bailouts followed, but so did millions of foreclosures, job losses, and a full-blown recession.

European Sovereign Debt Crisis (2009)

Credit: Wikimedia Commons

The European Sovereign Debt Crisis unfolded in 2009 when countries like Greece, Portugal, and Ireland couldn’t pay their bills. Budget deficits ballooned, and suddenly, the eurozone looked wobbly. Greece took multiple bailouts while citizens protested austerity in the streets. Germany and the IMF stepped in, but trust in the euro took a hit.

COVID-19 Recession (2020)

Credit: flickr

In early 2020, the world hit pause. As COVID-19 spread, businesses shut down, travel froze, and stock markets plummeted. Global GDP shrank faster than during the Great Depression. Governments pumped in trillions to keep things afloat, and Zoom meetings replaced boardrooms. It was a crash fueled by fear, uncertainty, and a virus no one saw coming.

The Mississippi Bubble (1720)

Credit: Wikimedia Commons

France learned a brutal lesson in 1720 when the Mississippi Bubble collapsed. Fueled by wild speculation in John Law’s trading company, share prices exploded, then imploded almost overnight. Investors lost fortunes, confidence in paper money evaporated, and the French economy staggered for years as trust in financial institutions quietly unraveled.

The Panic of 1873

Credit: Wikimedia Commons

The Panic of 1873 began with railroad overbuilding and risky speculation in Europe and the United States. When major banks failed, markets froze fast. Stock exchanges closed, businesses collapsed, and unemployment surged. The crash triggered a long global depression, reminding investors that industrial growth could collapse just as quickly as it rose.