Unless you’re among the world’s wealthiest, you’re probably not going to have the capital to invest in a professional sports franchise anytime in the near future. Indeed, it’s a truly rich person’s game, with team prices routinely going for nine figures and, quite often in today’s economy, north of $1 billion.

Take, for instance, former Microsoft CEO Steve Ballmer’s purchase of the Los Angeles Clippers in 2014 for $2 billion — a staggering sum for a team that has had only 12 winning seasons in almost 50 years of existence.

Still, that doesn’t mean we can’t dream. We took a look at the top half of Forbes’ annual “World’s 50 Most Valuable Sports Teams” list and calculated just how good an investment each of the top 25 franchises has been.

#1: Dallas Cowboys (NFL)

Dallas Cowboys owner Jerry Jones stands on the field before the Cowboys’ NFL football game against the Green Bay Packers in 2009, in Green Bay, Wis. Jim Prisching / AP Photo

Owner: Jerry Jones

Current Value: $4.2 billion

Acquired: $140 million (1989)

Return on a Dollar: $30

Bottom Line

There probably isn’t a safer bet in professional sports than gambling on Jones, who took on a moribund organization that was hemorrhaging cash when he purchased “America’s Team.”

Today, not only are the Cowboys the most valuable sports franchise in the world, but much of the NFL’s recent financial success is due to Jones’ direct hand in negotiating the league’s current TV deals that reportedly top more than $7 billion.

He is perhaps the most powerful sports executive in the world.

* Data comes from Forbes’ “World’s 50 Most Valuable Sports Teams” list.

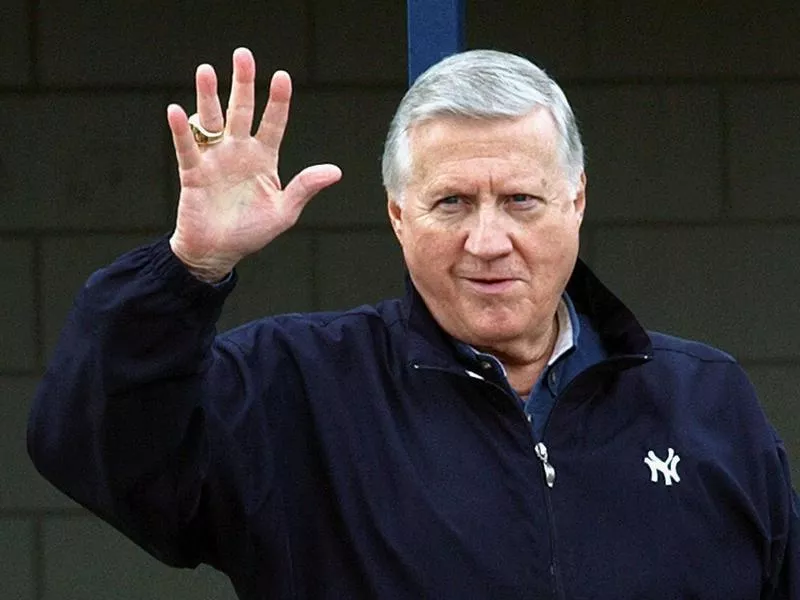

#2: New York Yankees (MLB)

New York Yankees owner George Steinbrenner waving to fans in Tampa, Fla, in 2003. Chris O’Meara / AP Photo

Owner: Yankee Global Enterprises

Current Value: $3.7 billion

Acquired: $10 million (1973)

Return on a Dollar: $370

Bottom Line

Investing in George Steinbrenner in 1973 would’ve been the equivalent of betting on the future of baseball.

“The Boss” helped usher in the modern era of the game by being the first owner to spend big money on free agents, sell the team’s television rights to cable providers and, ultimately, start his own cable network to carry the games.

Upon his death in 2010, Steinbrenner left the team to his four children, and today the Yankees are worth $1 billion more than the next most-valuable baseball franchise.

#3: Manchester United FC (English Premier League)

Manchester United’s Henrikh Mkhitaryan celebrates scoring the first goal during the Premier League soccer match between Manchester United and Tottenham Hotspur in Manchester, England, in 2016. Dave Thompson / AP Photo

Owner: Manchester United PLC

Current Value: $3.69 billion

Acquired: $1.4 billion (2005)

Return on a Dollar: $2.64

Bottom Line

Malcolm Glazer’s leveraged buyout of England’s most successful soccer team has been a rollercoaster ride.

The late American football tycoon spent a fortune in debt to acquire shares of the once-public club between 2003 and ’05, and then attempted to recoup nearly all of it in subsequent refinancing and a new IPO in the following years.

Today, 10 percent of the club is traded on the New York Stock Exchange and United still earns $765 million in revenue, the highest figure in world soccer.

#4: FC Barcelona (Spanish Primera División)

FC Barcelona players celebrate after scoring against Athletic Bilbao during their 2009 Copa del Rey match at the Mestalla stadium in Valencia. Manu Fernandez / AP Photo

Owner: Club members

Current Value: $3.64 billion

Acquired: N/A

Return on a Dollar: N/A

Bottom Line

The motto of the world’s second most valuable soccer team is “Més que un club” – Catalan for “more than a club.”

That’s accurate: Barça is operated like a public trust, which means you can only buy a membership in the organization and become one of the 150,000 or so socis, as they’re called.

Rather be president? You have to be an active member, get close to 2,500 others to endorse you and pony up a bond of roughly $85 million.

#5: Real Madrid CF (Spanish Primera División)

Real Madrid’s Luka Modric kisses the trophy after the Champions League final soccer match between Real Madrid and Atletico Madrid at the San Siro stadium in Milan, Italy, Saturday, May 28, 2016. Real Madrid won 5-3 on penalties after the match ended 1-1 after extra time. Luca Bruno / AP

Owner: Club members

Current Value: $3.58 billion

Acquired: N/A

Return on a Dollar: N/A

Bottom Line

Real Madrid’s ownership structure is nearly identical to its archrivals above on this list, although it has about two-thirds as many members.

The presidential structure is also close to the same, as is the club’s international brand value and high spending habits.

The biggest difference? Success on the field. Madrid is the most prolific club in European history, with 33 league titles and a record 12 UEFA Champions League trophies.

#6: New England Patriots (NFL)

New England Patriots owner Robert Kraft embraces quarterback Tom Brady after defeating the Jacksonville Jaguars in the AFC championship NFL football game on Jan. 21, 2018. Winslow Townson / AP Photo

Owner: Robert Kraft

Current Value: $3.4 billion

Acquired: $172 million (1994)

Return on a Dollar: $19.77

Bottom Line

A lifelong Bostonian and Patriots fan, Kraft shrewdly positioned himself for his marquee investment originally by buying the land around the team’s home in 1985, the stadium three years later and, finally, the team itself in 1994.

Eight years later, Kraft privately financed the $325 million construction of Gillette Stadium. His Patriots have been to eight Super Bowls under his watch, winning five times.

#7: New York Knicks (NBA)

New York Knicks’ Tyson Chandler after dunking during a 2012 game against the Brooklyn Nets at Madison Square Garden in New York. AP Photo/Mary Altaffer / AP Photo/Mary Altaffer

Owner: The Madison Square Garden Company

Current Value: $3.3 billion

Acquired: $1.1 billion (1994)

Return on a Dollar: $3

Bottom Line

There hasn’t been a ton of winning on the court during James Dolan’s time in charge of the Knicks – just four playoff appearances in the last 16 seasons – but there’s been a lot of winning off it.

Since Cablevision spun off its sports properties in 2010, the Knicks have enjoyed a near 600 percent increase in value in part thanks to a $1 billion upgrade to their iconic Manhattan digs, which also hosts concerts and other live events.

#8: New York Giants (NFL)

New York Giants co-owners John Mara, left, holding the Vince Lombardi Trophy, and Steve Tisch, holding the Halas Trophy, during the team’s NFL football 2012 Super Bowl parade in New York. Julio Cortez / AP Photo

Owner: John Mara and Steve Tisch

Current Value: $3.1 billion

Acquired: $500 (1925)

Return on a Dollar: $6.2 million

Bottom Line

The Giants have such a long history, they remain a symbol of economic perseverance through the Great Depression.

They were the first East Coast team to join the fledgling NFL after businessman Tim Mara paid $500 to place them in the league, and he held them as a family asset to safeguard against the 1929 stock market crash.

The Tisch family bought into the organization in 1990, and it’s still jointly owned by both families today.

#9 (tie): San Francisco 49ers (NFL)

Former San Francisco 49ers quarterback Joe Montana, left, talks with John York, San Francisco 49ers co-chairman and father of owner Jed York, before a game in 2014. John Froschauer / AP Photo

Owner: Denise DeBartolo York and John York

Current Value: $3 billion

Acquired: $17 million (1977)

Return on a Dollar: $176

Bottom Line

The 49ers are still in the DeBartolo family, but it’s been a rocky ride.

Shopping mall magnate Eddie DeBartolo was considered a model owner during his tenure, as the team won five Super Bowls. But gambling fraud charges forced him to cede his stake to his sister (and her husband) in 1997.

The Niners have fallen out of the NFL elite, but the Yorks did succeed where DeBartolo failed in building the team a state-of-the-art new home: the $1.2 billion Levi’s Stadium.

#9 (tie): Los Angeles Lakers (NBA)

Los Angeles Lakers owner Jerry Buss on the court during the NBA championship ring ceremony as Kobe Bryant and Derek Fisher look on in 2010. Chris Carlson / AP Photo

Owner: Buss Family Trusts

Current Value: $3 billion

Acquired: $67 million (1979)

Return on a Dollar: $44.78

Bottom Line

Jerry Buss returned the Lakers to glory shortly after he purchased the team for a relative song in 1979, as the team went on to win another 10 NBA titles before his death in 2013.

His six children jointly retain a 66 percent stake in the franchise, but the team has suffered through an unprecedented four straight losing seasons.

That hasn’t prevented the Lakers from a record high valuation, thanks to a lucrative 20-year, $3.6 billion TV deal.

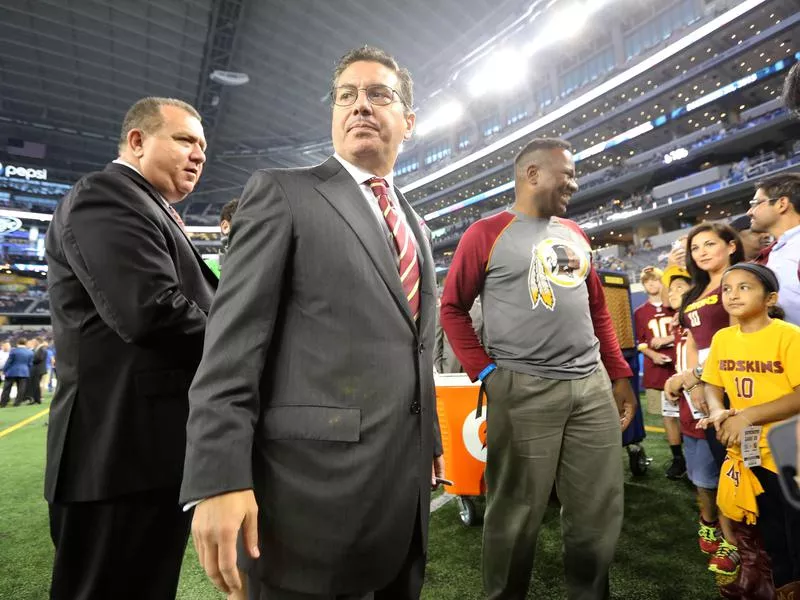

#11: Washington Redskins (NFL)

Washington Redskins owner Daniel Snyder with fans before a game against the Dallas Cowboys in 2013, in Arlington, Texas. LM Otero / AP Photo

Owner: Daniel Snyder

Current Value: $2.95 billion

Acquired: $800 million (1999)

Return on a Dollar: $3.69

Bottom Line

Dan Snyder certainly knows how to spot a good investment, as his then-record bid price for the Redskins has nearly quadrupled over two decades.

However, his ownership has been contentious. If it’s not the losing — the ’Skins have been to the playoffs just four times, and have won only one playoff game — it’s his resistance to constant pressure to change the team name, which many deem offensive to Native Americans.

#12: Los Angeles Rams (NFL)

Rams owner Stan Kroenke talks to the media in 2016 about the team’s move from St. Louis to Los Angeles. Nick Ut / AP Photo

Owner: Stan Kroenke

Current Value: $2.9 billion

Acquired: $450 million (2010)

Return on a Dollar: $6.44

Bottom Line

Apparently you can go home again — and you can put a price on it, too.

Kroenke’s controversial decision to move the Rams from St. Louis back to L.A. has seen the value of the franchise double in one year.

That’s in large part due to the $2.6 billion cathedral Kroenke is building in Inglewood to serve not only as the Rams’ permanent home (and leased to the L.A. Chargers as well), but also as host the Super Bowl in 2022, college football’s national championship in 2023 and, potentially, World Cup matches in 2026.

#13 (tie): New York Jets (NFL)

Woody Johnson, owner of the New York Jets at the 4th annual NFL Honors at the Phoenix Convention Center Symphony Hall on Jan. 1, 2015. Jordan Strauss / Invision for NFL/AP Images

Owner: Woody Johnson

Current Value: $2.75 billion

Acquired: $635 million (2000)

Return on a Dollar: $4.33

Bottom Line

Johnson had big plans for the Jets when he purchased the team, vowing to move them into their own home on the west side of Manhattan in a proposed $1 billion-plus project. But the initiative fell apart in 2005.

Instead, Johnson entered into a 50-50 partnership with their landlords – the New York Giants – on a new stadium in New Jersey.

The subsequent opening of the $1.6 billion MetLife Stadium has helped the Jets more than double in value since the 82,500-capacity buidling’s opening in 2010.

#13 (tie): Los Angeles Dodgers (MLB)

Los Angeles Dodgers owners and Guggenheim Baseball Management partners Peter Guber, Stan Kasten, Mark Walter and Magic Johnson walk into Dodger Stadium in Los Angeles in May 2012. Damian Dovarganes / AP Photo

Owner: Guggenheim Baseball Management

Current Value: $2.75 billion

Acquired: $2.15 billion (2012)

Return on a Dollar: $1.28

Bottom Line

You wouldn’t have made a huge return if you were part of the consortium that paid a record sum for a baseball team in 2012, but you’d have this going for you: The monstrous $2.15 billion purchase of the Dodgers was done completely in cash (just a small part of Guggenheim’s near $300 billion in assets under management).

The Dodgers also enjoy the best (yet most controversial) TV contract in baseball, a 25-year deal worth a reported $8.3 billion.

#15: Bayern Munich (German Bundesliga)

Bayern’s Arturo Vidal carries a mock trophy as he and his teammates celebrate winning the German soccer champion title in Wolfsburg, Germany in April 2017. Michael Sohn / AP Photo

Owner: FC Bayern München AG

Current Value: $2.71 billion

Acquired: N/A, last major investment in 2014

Return on a Dollar: $1.51

Bottom Line

Three-quarters of the shares of Germany’s most prolific soccer team is owned by the club, so there is no single majority shareholder.

However, its last significant infusion of external cash came in 2014 when financial conglomerate Allianz invested 110 million euros for a 8.3 percent stake in the club (equating roughly to a $1.8 billion total valuation).

Since then, Bayern has won four consecutive league titles and continues to expand its international footprint, including opening a marketing office in New York City.

#16 (tie): Chicago Bears (NFL)

Chicago Bears chairman Michael McCaskey, left, and owner Virginia McCaskey in 2007 as they are presented the George Halas Trophy after the Bears won the NFC championship football game in Chicago. Alex Brandon / AP Photo

Owner: Virginia Halas McCaskey

Current Value: $2.7 billion

Acquired: $100 (1920)

Return on a Dollar: $27 million

Bottom Line

A dollar into $27 million? If only you knew “Papa Bear” way back when.

The Bears boast the longest-tenured ownership by one family in American sports, dating back nearly 100 years to when legendary patriarch George Halas paid a paltry $100 franchise fee to place the then-named Decatur Staleys into the forerunner to the NFL.

Today, his eldest child, Virginia, presides over one of the most valuable properties in the league.

#16 (tie): Boston Red Sox (MLB)

Boston Red Sox team owner John Henry greets fans before a baseball game at Fenway Park on June 9, 2017, in Boston. Elise Amendola / AP Photo

Owner: Fenway Sports Group

Current Value: $2.7 billion

Acquired: $700 million (2001)

Return on a Dollar: $3.86

Bottom Line

John Henry and his partners ended seven decades of family ownership when they bought the Red Sox from the Yawkeys in 2001.

But they forever earned the trust of Sox Nation in 2004 by delivering the team its first World Series title in 86 years (and two more since then).

In 2010, Fenway Sports Group paid $476 million to add Liverpool FC to its portfolio. The storied English soccer club is now currently valued at $1.5 billion.

#18: Chicago Cubs (MLB)

Chicago Cubs’ owner Tom Ricketts talks to reporters in 2011 in Chicago. Charles Rex Arbogast / AP Photo

Owner: Ricketts Family Trust

Current Value: $2.68 billion

Acquired: $845 million (2009)

Return on a Dollar: $3.17

Bottom Line

When he bought the woebegone Cubs, investment banker Tom Ricketts hoped he and his family would be the ones to reverse a similar curse to Boston’s, and deliver the rabid fan base its first title since 1908.

He held up his end: Chicago won a seven-game classic of World Series in 2016.

Glory comes at a price, however: Cubs tickets are now the most expensive on average in all of baseball.

#19: San Francisco Giants (MLB)

San Francisco Giants relief pitcher Brian Wilsonafter being presented with his 2010 World Series championship ring with Giants owner Bill Neukom, center, and president Larry Baer in San Francisco in April 2011. Eric Risberg / AP Photo

Owner: San Francisco Baseball Associates LLC

Current Value: $2.65 billion

Acquired: $100 million (1993)

Return on a Dollar: $26.50

Bottom Line

The Giants’ current ownership structure has been in place since Peter Magowan led a group of local investors to save the team from relocating to St. Petersburg, Florida.

Magowan still owns a stake in the franchise, but is no longer the lead investor. Still, he was key in ushering in a golden era for the Giants, which includes the opening of $357 million AT&T Park in 2000 and winning three World Series titles between 2010 and 2014.

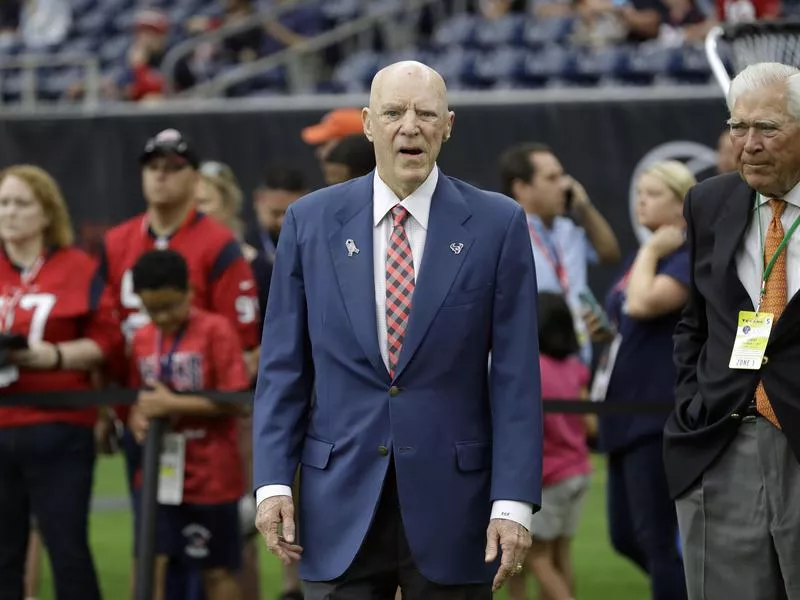

#20 (tie): Houston Texans (NFL)

Houston Texans owner Bob McNair before an NFL football game against the Indianapolis Colts in 2017 in Houston. David J. Phillip / AP Photo

Owner: Bob McNair

Current Value: $2.6 billion

Acquired: $700 million (1999)

Return on a Dollar: $3.71

Bottom Line

McNair may not be the savviest when it comes to political statements, but he knew what he was doing when he financed a record $700 million expansion fee to bring NFL football back to Houston.

The Texans play in a cathedral of a home in NRG Stadium and consistently rank in the NFL’s top 10 in attendance.

In less than 20 years, his franchise has nearly quadrupled in value.

#20 (tie): Golden State Warriors (NBA)

Golden State Warriors owner Joe Lacob, right, and Nicole Curran during a parade and rally after winning the NBA basketball championship on June 15, 2017 in Oakland, Calif. Marcio Jose Sanchez / AP Photo

Owner: Joe Lacob

Current Value: $2.6 billion

Acquired: $450 million (2010)

Return on a Dollar: $5.78

Bottom Line

When venture capitalist Lacob purchased his majority stake in the Dubs, they were a middling franchise with a valuation below the league average.

Seven years later, they’re the third-most valuable in the NBA and by far its hottest ticket.

Golden State finished with the league’s best record the last three seasons (including a record 73 wins in 2015-16), and added two titles to the trophy case. In 2019, they’ll move back across the San Francisco Bay into the $1 billion Chase Center.

#22 (tie): Philadelphia Eagles (NFL)

Philadelphia Eagles owner Jeffrey Lurie, center, with head coach Doug Pederson, left, and quarterback Nick Foles hugs his wife, Tori, after winning Super Bowl 52 against the New England Patriots on Feb. 4, 2018, in Minneapolis. Frank Franklin II / AP Photo

Owner: Jeffrey Lurie

Current Value: $2.5 billion

Acquired: $195 million (1994)

Return on a Dollar: $12.82

Bottom Line

At long last, Boston native Lurie escaped the shadow of his boyhood team.

He lost out to a record high bid in his efforts to acquire the Patriots in 1994, so he instead bought the Eagles for an even higher record sum. A year after New England got its $325 million new stadium, Lurie built his for $187 million more.

Super Bowls? New England still has the edge, with five. But Philly and Lurie finally got their first – beating those pesky Patriots in a thriller in February.

#22 (tie): Chicago Bulls (NBA)

Chicago Bulls owner Jerry Reinsdorf speaks on stage during the Naismith Memorial Basketball Hall of Fame class of 2016 announcement in Houston, Texas. Charlie Neibergall / AP Photo

Owner: Jerry Reinsdorf

Current Value: $2.5 billion

Acquired: $16 million (1985)

Return on a Dollar: $156

Bottom Line

Reinsdorf, who has also been the principle owner of Major League Baseball’s Chicago White Sox since 1981, clearly knows a thing or two about timing.

He bought into the local NBA team not long after it drafted a scrawny North Carolinian named Michael Jordan — who promptly led the team to six titles over eight seasons.

The Bulls haven’t been back to the NBA Finals since 1998, but Reinsdorf’s time in charge has still seen the team maintain massive financial success, both at the gate and in TV money, in the third-largest market in America.