How Warby Parker Exposed the Monopoly Controlling the Eyewear Industry

For years, buying glasses felt strangely expensive for something so basic. Frames, lenses, exams, and insurance all came with inflated prices, yet most shoppers had no idea why. Behind the scenes, one powerful company controlled a significant portion of the eyewear supply chain by limiting competition and driving up costs. Warby Parker entered that system as an outsider and started asking uncomfortable questions. In doing so, the brand helped expose the concentration of the eyewear industry and why consumers were paying the price.

The $800 Glasses That Sparked a Business Plan

Credit: Canva

Dave Gilboa was not planning to launch a business when he lost his glasses while backpacking in Thailand. Replacing them ended up costing more than the iPhone he had just bought, and the imbalance stuck with him. That moment of frustration turned into long conversations with friends about why eyewear was priced the way it was. Those late-night exchanges eventually shaped the basic idea behind Warby Parker’s direct-to-consumer approach.

The Eyewear Industry’s Best-Kept Secret

Credit: Facebook

Before Warby Parker arrived, most consumers had no idea how concentrated the eyewear industry had become. A single company, EssilorLuxottica, owned major frame brands, manufactured lenses, ran well-known retail chains, and even controlled vision insurance. That level of control meant customers were often paying inflated prices at multiple points without realizing it.

A Name Pulled From Kerouac and a Mission Pulled From Reality

Credit: Wikimedia Commons

The name “Warby Parker” came from two characters in Jack Kerouac’s journals, but the business plan was rooted in affordability and access. The founders believed glasses should be like shoes: own more than one, switch them with your mood, and never feel ripped off. They designed the frames in-house and sold them for $95, including the lenses.

The Home Try-On Gimmick That Actually Worked

Credit: Youtube

Mailing people five pairs of glasses to try at home sounded risky, yet it turned out to be one of Warby Parker’s best moves. Shoppers got the feel of a physical store without leaving their couch. That one idea helped them build brand loyalty and reach customers in places where eyewear boutiques didn’t even exist.

GQ Said ‘Netflix for Glasses’—Then They Sold Out

Credit: pexels

Before Warby Parker spent a dime on ads, it was featured in GQ and Vogue. That publicity created a waitlist of 20,000 people. Their first-year sales goal was gone in three weeks. The team emailed buyers directly and even invited locals into their apartment to try frames.

They Sell and Give Away Glasses

Credit: Instagram

From the start, Warby Parker built giving into its model. Its “Buy a Pair, Give a Pair” program uses each purchase to help fund glasses for people in need. The company partners with nonprofits like VisionSpring, allowing customers to support wider access to vision care while buying their own.

The Monopoly Didn’t Like Competition—And Took It to Court

Credit: pexels

Legal pressure came early. Warby Parker drew attention from established players after bidding on competitors’ brand names in search ads, including “1-800 Contacts.” That move triggered years of back-and-forth over trademark use and online advertising rules. The dispute highlighted the challenges faced by new brands in competing in digital eyewear marketing.

Retail Stores Became Showrooms, Not Just Shops

Credit: Instagram

Warby Parker designed their locations to double as brand hubs. Each space was minimalist, accessible, and backed by an in-house tech system that linked inventory and customer data. Instead of just moving products, stores introduced people to the experience—something the big players rarely bothered to offer.

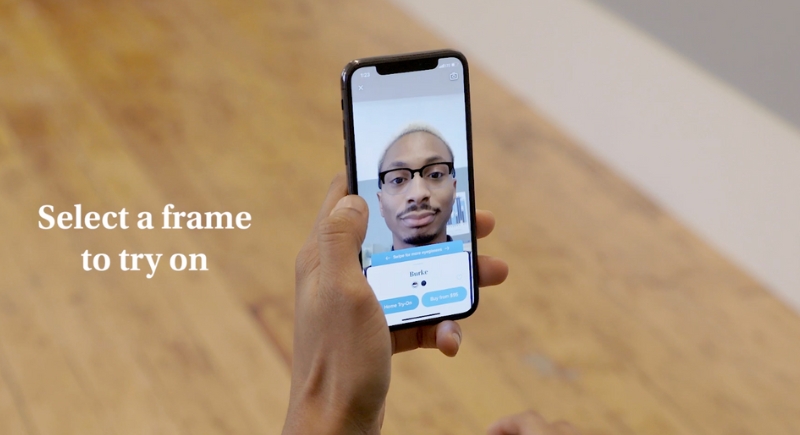

Their Tech Was Built In-House, Not Bought Off-the-Shelf

Credit: Youtube

They developed their own point-of-sale system and mobile tools like Virtual Try-On. That gave them flexibility to adapt, integrate e-commerce with retail, and control everything from warehouse to checkout. Legacy brands? Still stuck piecing together outdated systems.

A Public Listing with a Founder-Led Twist

Credit: Instagram

When Warby Parker went public in 2021, it didn’t hand over control to investors. The co-founders retained super-voting shares, which allowed them to maintain long-term control of the company. Few public companies can make the same claim, especially in an industry built on markups and market control.