15 Small Things That Can Save a Lot of Money

You’d be surprised how fast small expenses pile up. Twenty dollars can vanish between a few takeout orders or another coffee you didn’t need. But small choices can help you save. Simple habits like packing lunch or canceling unused subscriptions can build up real savings without much effort.

Meal Prep Beats the Lunch Line

Credit: Getty Images

Packing lunch instead of buying it every day can save over $2,000 a year, according to Forbes. Even prepping just a few meals per week helps. Leftovers stretch further, and grocery bills get more predictable. Plus, reheating something made at home usually takes less time than standing in line.

Use the Library for More Than Books

Credit: Canva

Libraries have evolved. Beyond books, many lend out power tools, video games, museum passes, and even kitchen gear. Some host repair cafes or free workshops. A library card might be the most valuable free thing in your wallet.

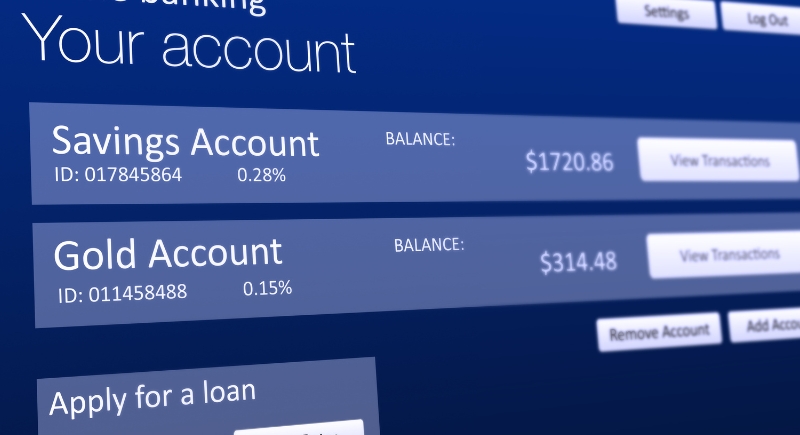

Set Up Auto-Savings on Payday

Credit: Getty Images

Letting savings happen automatically removes the temptation to skip it. Most banks allow paycheck splits or recurring transfers that send a set amount into savings the moment money arrives. This strategy is backed by behavioral economists: people are more likely to save consistently when the decision isn’t left for later.

Switch to a Cheaper Phone Plan

Credit: Canva

Mobile carriers change deals all the time, and many users overpay for features they rarely use. Switching to a low-cost plan—especially prepaid options—can reduce your bill by half. Consumer Reports found savings of over $600 a year for those who ditched traditional plans in favor of budget carriers.

Drink Tap Water Instead of Bottled

Credit: pixelshot

Bottled water may seem convenient, but it can cost over 2,000 times more than tap water, according to Food & Water Watch. Most U.S. tap water meets strict safety standards and is just as clean. Using a reusable bottle at home and on the go can cut unnecessary spending.

Embrace “No Spend” Days

Credit: pixelshot

Skipping purchases once or twice a week pushes you to get creative with what’s already around. Maybe that box of pasta in the back of the cupboard will finally get used. Or you pull out that dusty board game. Zero dollars, decent time.

Keep a Wishlist Instead of Buying Instantly

Credit: Getty Images

Online impulse buys often lose their charm 48 hours later. Parking items in a wishlist gives you room to reconsider. Some retailers will even toss you a discount code if you leave items lingering. Delayed gratification might not be exciting, but saving money kind of is.

Use a Cash Budget for Weekly Spending

Credit: pexels

Withdrawing a fixed amount of cash for weekly personal expenses sets a clear boundary. It’s harder to overspend when there’s no card swipe involved. Researchers at MIT found that people spend more freely with credit than with cash, so switching to bills and coins can make your wallet last longer.

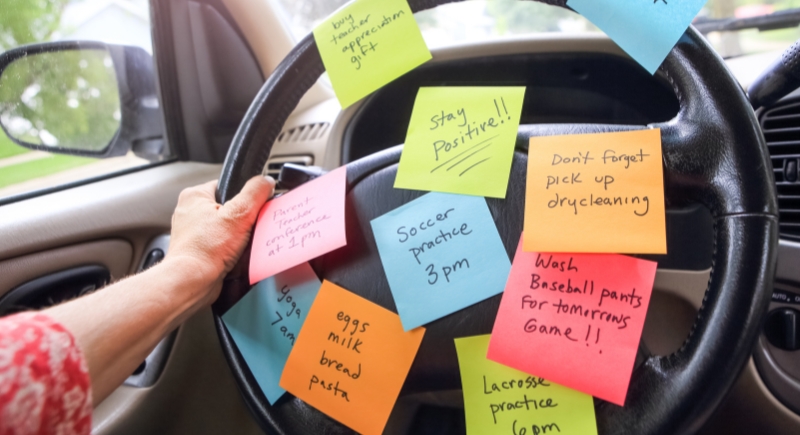

Cut Unused Subscriptions Without Guilt

Credit: Canva

It’s easy to lose track of what’s auto-renewing. One quick look through your statement might reveal you’re still paying for that yoga app you used twice or a streaming service you forgot existed. Canceling is a win-win: you’ll save money and regain a small chunk of control.

Skip the Drinks When Eating Out

Credit: Canva

A soda or glass of wine may feel minor, but skipping it can save $3–$7 per meal. Tap water is usually free, and avoiding extra beverages cuts both cost and calories. Over a month of dining out, those little savings quietly stack up.

Shop Your Pantry Before Buying More

Credit: Canva

Before going grocery shopping, take a look at what you already have. Treat your pantry like a small store. It’s probably stocked with more than you think. A can of beans, some rice, a few vegetables, and you’ve got dinner. Use what’s on your shelves first instead of filling your cart with things you don’t need.

Make a Habit of Comparing Prices

Credit: PeopleImages

Before checkout—online or in-store—a quick comparison can lead to better deals. Tools like Google Shopping, Honey, or CamelCamelCamel show price histories and coupon options in seconds. Being mindful of timing, like buying electronics in late summer or furniture in February, can also stretch dollars further.

Borrow Before You Buy

Credit: Getty Images

Before spending money on something you’ll use once, ask around. A cake stand, extra chairs, or a power washer might already be sitting in a neighbor’s garage. Check local Buy Nothing groups or Freecycle. A quick message can get you what you need without spending a dollar.

Batchto Save on Gas

Credit: Canva

Combining errands into one trip cuts down fuel use and time behind the wheel. AAA estimates that eliminating one round-trip drive each week could save the average driver over $300 in annual gas costs. Grouping stops by location and avoiding peak hours reduces wear and tear, too.

Cook in Batches and Freeze Extras

Credit: Canva

Doubling recipes and freezing half cuts down on meal prep later. It also helps resist pricey takeout when there’s no time to cook. Frozen portions of soup or stir-fry can be reheated quickly and cost a fraction of delivery. This habit also reduces food waste by using up perishable ingredients more efficiently.