Starbucks Just Announced a Wave of Store Closures as Part of a Major Restructuring

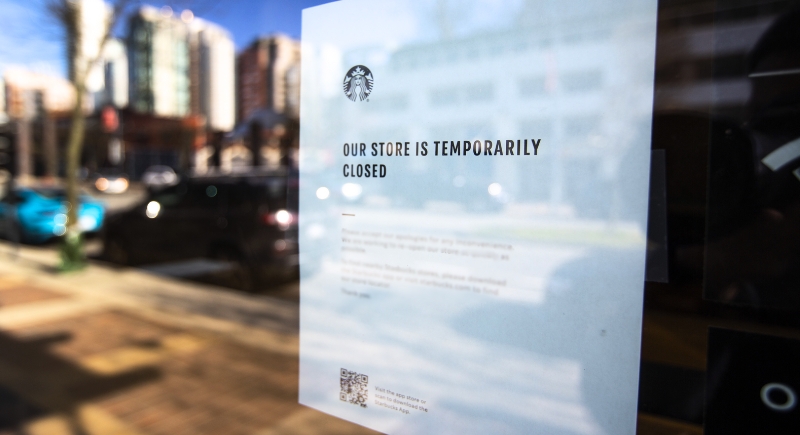

Starbucks is in the middle of one of its biggest shake-ups in years. CEO Brian Niccol, who took over in 2024 after a successful tenure at Chipotle, has announced a comprehensive $1 billion restructuring plan. The company confirmed that it will close about 1% of its coffeehouses across North America in fiscal year 2025, shrinking its footprint to around 18,300 stores in the U.S. and Canada. This means hundreds of locations will disappear, with closures focused on shops that either underperform financially or fail to deliver the kind of atmosphere the company says customers expect.

Alongside store closures, Starbucks is cutting roughly 900 non-retail jobs. This follows an earlier round of 1,100 corporate layoffs in February and a voluntary separation program offered in July, which paid some employees between $20,000 and $100,000 to leave. Affected staff will receive severance and benefits extensions. The company disclosed in its SEC filing that restructuring costs will total approximately $1 billion, with $150 million allocated for severance and $450 million tied to lease-related expenses. Most of these expenses will be absorbed by the North American business.

Remodeling Amid Competition and Customer Frustration

Image via iStockphoto/AlxeyPnferov

The closures don’t mean Starbucks is pulling back everywhere. The company still plans to remodel more than 1,000 stores over the next year by adding features such as improved seating and additional power outlets. It also expects to expand store openings in fiscal year 2026. Outside North America, growth remains part of the plan, with 80 new stores scheduled to open in the UK and 150 across Europe, the Middle East, and Africa. However, the portfolio review also flagged closures in the UK, Switzerland, and Austria.

North America remains the trouble spot. Starbucks has now logged six straight quarters of declining same-store sales in its largest market. In the third quarter of fiscal 2025, revenue rose slightly to $9.456 billion, but same-store sales dropped 2%. Customers are spending a little more per visit, but fewer of them are showing up, resulting in a 3% decrease in transaction volumes. Operating profit in North America plunged 36%, and the company’s overall net profit fell nearly 47% compared to the same period last year. Analysts say that competition from faster drive-through chains is eroding Starbucks’ business, while the brand’s reputation has weakened compared to that of its rivals.

The “Return to Starbucks” Gamble

Niccol calls this reset the “Return to Starbucks” plan, an effort to lure back customers who have drifted away and to make stores feel inviting again. Part of that strategy includes reinstating self-service condiment bars, simplifying the U.S. menu, and introducing new drinks, such as protein cold foam with 15 grams of protein and no added sugar. Niccol says the goal is for every store to feel like a warm, welcoming spot with a seat for every occasion, though that vision has clashed with reports of understaffed stores and long wait times.

Workers United, the union representing employees at more than 600 company-owned U.S. stores, has been vocal about those concerns. The group criticized the restructuring announcement, saying baristas had no input in decisions that directly affect them and warning that workloads are already overwhelming. Starbucks has acknowledged the disruption but insists the shake-up is needed to reset the business.

The Future of Starbucks

Image via Wikimedia Commons/GoToVan

The restructuring has put Starbucks in a tricky position. On one hand, it is closing stores and cutting jobs, swallowing significant costs. On the other hand, it is promising to upgrade thousands of shops while growing internationally and preparing for future expansion in North America. Investors have taken note of the turbulence, with shares falling by more than 8% so far this year, while customers await to see if the promised changes actually improve the store experience.

Meanwhile, Starbucks China is heading in a different direction. Same-store sales there finally rose in the third quarter, and the company is close to finalizing the sale of its Chinese business. Final candidates include Boyu Capital, Carlyle Group, EQT, and Sequoia China, with a decision expected by the end of October 2025. Once completed, that deal could reshape Starbucks’ global strategy just as dramatically as Niccol’s restructuring is reshaping North America.