15 Things Your Car Insurance Won’t Help You With (Until It’s Too Late)

Car insurance feels like a safety net until something unexpected happens and you realize it’s got holes. A lot of people assume it covers everything, but that’s not always true. Some gaps in coverage can hit your wallet hard, especially when life throws something weird your way.

Intentional Damage or Fraud

Credit: Getty Images

Insurance policies do not cover intentional damage. If you vandalize your own vehicle or someone else’s property, your insurer will deny the claim. Attempting to profit from such acts is classified as fraud, which can lead to policy cancellation and potential legal consequences, including fines or criminal charges.

Costs Above Coverage Limits

Credit: Industrial Photograph

If the cost of an accident exceeds your coverage limits, you’ll be responsible for the rest. For instance, with a $25,000 property damage limit, damaging a $50,000 car leaves you on the hook for $25,000. Higher liability limits and umbrella policies can help protect your financial assets in the long term.

Routine Wear and Tear

Credit: Getty Images

Basic car insurance does not include coverage for routine wear and tear. Issues like bald tires, squeaky brakes, or worn-out spark plugs are considered part of regular upkeep and must be paid for out of pocket. These are maintenance costs, not accidents or unexpected losses under your policy.

Mechanical Breakdowns

Credit: Shutter2U

Mechanical breakdowns not caused by a crash are excluded from regular policies. Insurance covers collisions and natural disasters, but not sudden engine failure or transmission issues. Mechanical breakdown insurance (MBI) is a separate product that is usually available for new vehicles under specific age and mileage thresholds.

Pet Injuries After Accidents

Credit: southworks

Your pet’s injuries in a car accident may not be covered unless your insurer includes specific protection. For example, Progressive offers up to $1,000 for vet bills after a covered accident. Without this add-on or separate pet insurance, any emergency treatment will be entirely your financial responsibility.

Stolen Personal Items

Credit: Getty Images

Auto policies do not reimburse stolen belongings left inside your car. That includes laptops, shopping bags, or gym gear. These items fall under renters’ or homeowners’ insurance. Before leaving valuables behind, it’s smart to know your other coverage details in case of theft or break-in.

Racing and Stunt Damage

Credit: pexels

Crashes that happen during street racing, stunt driving, or high-speed track use are not covered under a standard car insurance policy. These risky activities require motorsport-specific insurance.

Business Use Without Proper Coverage

Credit: Getty Images

Using your car for rideshare driving or food delivery makes your personal auto insurance invalid during work hours. Uber and Lyft offer limited protections, but these have gaps. To stay protected, get rideshare coverage or a commercial auto policy tailored to your type of driving activity.

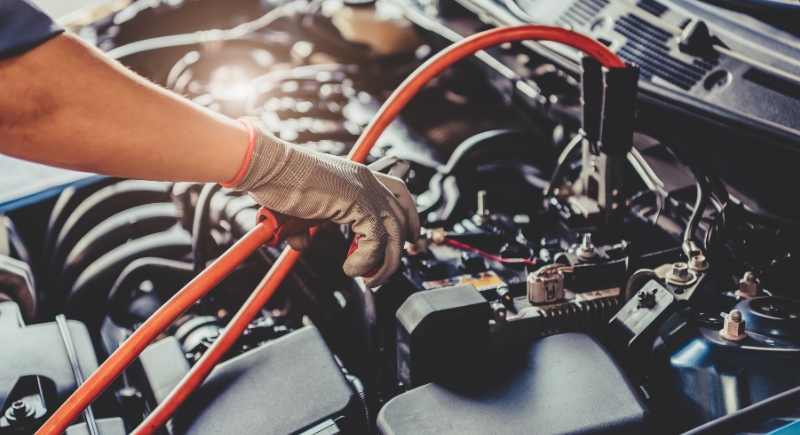

Roadside Help Isn’t Standard

Credit: Canva

Standard auto insurance doesn’t cover towing, fuel delivery, lockouts, or jumpstarts unless you add roadside assistance. Some insurers offer it as an add-on, while services like AAA provide third-party coverage.

Total Loss Without Gap Coverage

Credit: Getty Images

If your car is totaled, your insurer pays its actual cash value, which includes depreciation. That may be thousands less than what you still owe. Gap insurance covers the difference between what your car is worth and what you owe, and is essential for long-term or low-down loans.

Glass Repair Restrictions

Credit: Getty Images

Damage to windows and mirrors from rocks or weather isn’t always included unless you buy comprehensive coverage or a separate glass rider. Many insurers exclude minor glass repairs unless specified. If you regularly drive on highways, adding this protection can save you from out-of-pocket glass replacement costs.

Natural Disaster Gaps

Credit: Getty Images

Living in a disaster-prone area? Make sure your policy explicitly covers earthquakes, floods, or hailstorms. Some natural disasters fall outside standard coverage or carry strict limits. To avoid surprises, ask your provider about exclusions and consider adding extra protections if you’re in a high-risk zone.

Undeclared Vehicle Modifications

Credit: pexels

Failing to notify your insurer about customizations like tinted windows or a new tow hitch can backfire. If your policy doesn’t reflect these changes, they may deny claims entirely. Always report modifications to ensure your coverage is valid when filing for damage involving those altered components.

Unlisted Household Drivers

Credit: Syda Productions

Anyone living with you who drives must be listed on your policy. If they’re excluded and cause an accident, your insurance won’t pay a dime. Many insurers require that household members’ licenses be disclosed. It’s a key detail that can make or break your claim.

Uninsured Driver Accidents

Credit: Monkey Business Images

If you’re hit by an uninsured driver, your liability coverage won’t help. You’ll need uninsured motorist coverage to pay for injuries or damage. It’s optional in some states but highly recommended. This protection also kicks in when the at-fault driver’s policy falls short of covering full losses.