Psychological Tactics Retailers Use to Encourage Customers to Spend More

A quick stop at the store usually feels simple. Pick up shampoo, maybe toss in a snack, and head out. But retailers have turned shopping into a subtle psychological game. Behind the layout and prices are deliberate strategies meant to nudge your choices and your wallet. These tactics aren’t new, but they’re getting smarter and harder to notice. Here’s a closer look at the tricks retailers use to influence you quietly.

The Countdown Clock That Never Ends

Credit: Canva

A ticking timer appears urgent, as if the deal will vanish in seconds. But in many cases, it’s just a loop. A PIRG investigation found 80% of countdowns reset without price changes. The goal here isn’t a deadline, but the pressure. That little clock prompts your brain to buy faster than you planned.

Bigger Carts, Bigger Bills

Credit: Canva

It’s not an accident that shopping carts have grown over the years. Retail design experts have found that giving shoppers more space often leads to higher spending, since a half-empty cart can make purchases feel smaller than they are.

Prices That End in .99 Still Fool Us

Credit: iStockphoto

A price like $19.99 looks cheaper than $20, even though it’s basically the same. That’s called the left-digit effect. Our brains latch onto the “1” and treat the price as lower. This works even when we know better. Removing commas in large prices, like showing $1999 instead of $2,000, can also make expensive items seem less daunting.

That “Sale” Might Be the Everyday Price

Credit: Canva

Secret shoppers at Consumers’ Checkbook tracked prices for six months and discovered many big-name stores keep the same “sale” prices running all the time. These discounts are often fake-outs, meant to give you the thrill of saving money without offering real savings.

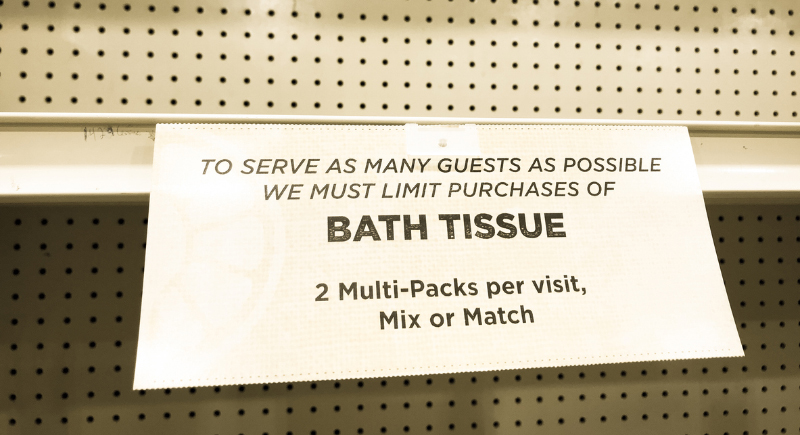

Only 2 Left… Supposedly

Credit: iStockphoto

Low-stock warnings, such as “Only 3 left” or “20 people are viewing this right now,” are designed to prompt you. They trigger a fear of missing out and prompt you to make a decision before you have time to think. In many cases, the scarcity is overstated. The item may still be widely available, but the message creates a sense of urgency, making a quick purchase feel safer than slowing down to reconsider.

BOGO’s Hidden Trap

Credit: iStockphoto

Buy-one-get-one deals sound generous, even when you only wanted one. The offer nudges you to take more than planned, which raises total sales. Retailers often use this with perishables or cosmetics, items that have a short shelf life or tend to go unused. What looks like a bonus usually turns into extra money spent on things you did not actually need.

Buy Now, Pay Later—Spend More Without Noticing

Credit: Canva

Splitting payments into smaller monthly chunks feels easier. That’s why stores love “buy now, pay later” options. However, spreading costs can obscure the actual amount you’re spending. A Klarna-backed study even admitted that impulse buys rise with installment plans. Shoppers underestimate the total and click “buy” more freely when the price feels bite-sized.

Store Layouts That Steer You on Purpose

Credit: Canva

Supermarkets often place fresh produce and flowers near the entrance. The colors boost your mood, and those healthy picks make you feel better about grabbing treats later. Behavioral research shows that starting out with “good” choices makes it easier to justify extra indulgences as you move through the rest of the store.

Free Shipping… With a Catch

Credit: Getty Images

No one likes paying for shipping, and retailers count on that. By setting a free shipping threshold—say, $50—they nudge you to add that extra $9 item you didn’t need. It’s a calculated move. And often, the shipping fee would’ve been cheaper than the thing you bought to avoid it.

Loyalty Cards That Nudge Extra Spending

Credit: Getty Images

Store loyalty programs highlight special prices and “exclusive” deals that make savings feel personal. While some offers can be genuine, consumer research shows these prices are often comparable to standard prices at competing stores. The sense of being rewarded can still encourage shoppers to spend more or buy items they might otherwise skip.