10 Money Mistakes Warren Buffett Says Are Keeping the Middle Class Broke

Warren Buffett didn’t build billions chasing shiny trends or falling for financial fads—and middle-class families could learn a lot by following his lead. His philosophy centers on patience, discipline, and understanding the value of every dollar. Unfortunately, many everyday spending habits quietly sabotage long-term wealth without anyone noticing until it’s too late. We’re unpacking money-wasting traps that Warren would steer clear of, reinterpreted through his timeless principles.

Buying Brand-New Cars

Credit: pexels

Drive it off the lot, and it’s already worth less. New cars lose thousands in value instantly, and Buffett would never sign up for that. Opting for used or certified pre-owned keeps your money working elsewhere—like investments. Flashy wheels today can mean stalled wealth later, and Buffett doesn’t play that game.

Carrying Credit Card Debt

Credit: Canva

Interest rates north of 20%? That’s financial quicksand. Compounding is a force for building wealth, not destroying it. Carrying credit card debt negates any investment gain, savings effort, or budgeting strategy. If you’re paying double for yesterday’s coffee, your money is working against you.

Overspending on Housing

Credit: Getty Images

Bigger homes bring bigger headaches. Property taxes, maintenance, utilities—they all scale up fast. Warren Buffett still lives in his modest Nebraska house, and for good reason: Homes are for living, not flexing. Overspending on housing often locks families into paycheck-to-paycheck cycles.

Trading Too Often

Credit: Canva

The market rewards patience. Constant buying and selling racks up fees, taxes, and stress—none of which help your portfolio. Warren Buffett’s success didn’t come from chasing every trend but from letting solid investments grow. If you’re glued to stock tickers all day, your wallet might shrink while your anxiety grows.

Buying Into Get-Rich-Quick Schemes

Credit: Canva

Warren Buffett’s philosophy is that slow and steady wins every time. Chasing overnight success in penny stocks, crypto “next big things,” or social media side hustles usually ends in disappointment. These schemes prey on desperation and ignore fundamentals. Building wealth should be boring, reliable and never require luck or a viral video.

Ignoring Compound Growth

Credit: Getty Images

Every dollar not invested early is a snowball left at the top of the hill. Buffett credits compounding as the magic behind his billions. Most people wait too long to start investing or cash out too soon.

Eating Out Excessively

Credit: freepik

Warren Buffett grabs breakfast at McDonald’s—and only if the market’s up. Meanwhile, many folks burn hundreds monthly on takeout. Dining out occasionally is fine, but making it routine is costly. Those “quick bites” take long-term bites out of your savings without offering any return.

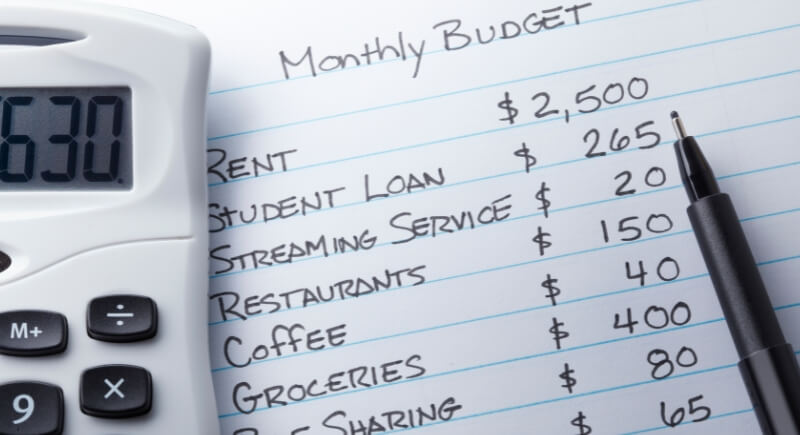

Failing to Budget

Credit: Getty Images

Money disappears fast when there’s no plan. Warren Buffett tracks everything—and not just in his portfolio. Without a budget, even high earners lose control. It’s important to know where your dollars are going. You can’t manage what you don’t measure.

Keeping Up with the Joneses

Credit: pexels

Your neighbor’s Tesla won’t fund your retirement. Instead of chasing status, chase value. Middle-class families often fall into the trap of trying to look rich instead of becoming rich. Expensive clothes, luxury vacations, and constant upgrades scream success—but they usually whisper “debt” behind closed doors. Live below, not beyond.

Leasing Instead of Owning

Credit: Canva

Warren Buffett builds equity. Leasing is the opposite—it’s renting something that depreciates, month after month, forever. For cars, tech, or even furniture, leasing often looks easy upfront but costs more in the long run. You leave with nothing in the end.

Not Investing in Themselves

Credit: pexels

Degrees collect dust if you stop learning. Warren Buffett spends hours reading and credits his success to lifelong learning. Middle-class earners often overlook personal development—whether it’s new skills, certifications, or even basic financial literacy. Growth starts with you. Investing in your mind might be the highest-yield decision you’ll ever make.

Failing to Shop Around

Credit: Getty Images

Loyalty has its limits. Paying more for convenience—insurance, utilities, subscriptions—is a silent money leak. Warren Buffett prizes frugality and informed decisions. Many families lose thousands by not comparing options. Shopping around isn’t about being cheap but being strategic. Every unnecessary dollar spent is a dollar that can’t compound or be invested elsewhere.

Ignoring Emergency Savings

Credit: Getty Images

Warren Buffett hoards cash for downturns—so should you. An emergency fund is a protection against high-interest debt. Without one, even a minor setback can turn into a financial crisis. Medical bills, car repairs, job loss—life happens. A cushion buys time, confidence, and peace of mind during chaos.

Making Emotional Money Decisions

Credit: Getty Images

Fear and greed are terrible advisors. Warren Buffett removes emotion from investing, yet many middle-class folks make impulsive purchases or panic during market dips. Emotional spending leads to regret. Financial decisions should be deliberate, not reactive. Let logic drive the car, not your feelings—or you’ll crash right into avoidable debt.

Overinsuring or Underinsuring

Credit: Getty Images

Insurance is about balance. Warren Buffett believes in managing risk, not obsessing over it. Too much coverage eats up cash for no reason; too little leaves you vulnerable when life hits hard. The middle class often overspends on peace of mind or skips essentials. Smart protection keeps your finances steady—not suffocated.

Financing Depreciating Toys

Credit: Canva

Dropping stacks on the newest kiddie contraptions? Baby sees an iPad, pops on play-dates, and the depreciation begins. Warren Buffett warns that splurging on “toys” that lose value faster than interest piles up is a middle-class money trap. Financing those fleeting thrills today means less cash fun tomorrow, and Warren is all about keeping wealth growing, not wilting.

Delaying Retirement Contributions

Credit: Getty Images

Putting off retirement contributions is like skipping a blockbuster premiere and expecting to catch up later, except the compound interest curtain has already closed. Warren Buffett preaches “pay yourself first,” not saving leftovers after rent and latte runs. Starting early builds that snowball: every missed month means less future wealth. Warren’s mindset: don’t delay the show.