7 Mistakes to Avoid When Picking a Mortgage Lender

Picking a mortgage lender is never thrilling, but it’s one decision you don’t want to get wrong. A bad pick can lead to higher costs, frustrating delays, and even missed opportunities. Knowing what to watch for can help you avoid costly headaches and keep your home-buying journey on track. Here are a few common mistakes you’ll want to steer clear of.

Not Getting Preapproved

Credit: Getty Images

Skipping preapproval is like showing up to a car lot with Monopoly money—you’ll get nowhere fast. Lenders use preapproval to figure out what you can afford, and sellers take you more seriously when you’ve got that golden ticket in hand.

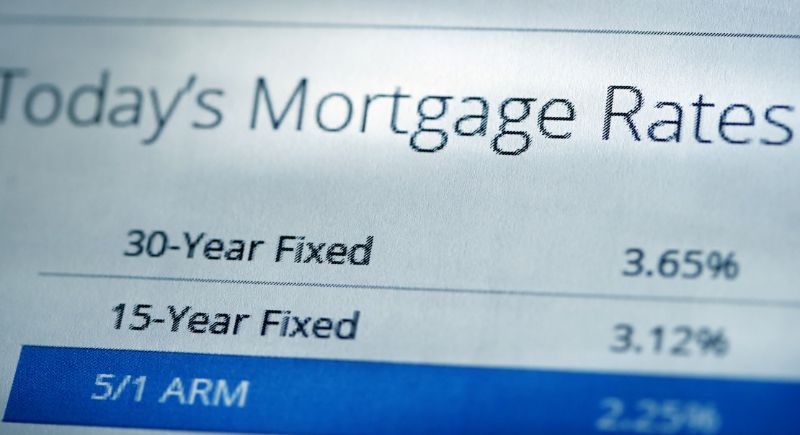

Choosing Based Solely On Interest Rate

Credit: bongkarngraphic

Sure, the lowest mortgage rate looks tempting, but that’s not the full picture. A rock-bottom rate might come with high fees, awful customer service, or inflexible terms. It’s kind of like booking the cheapest hotel and finding out there’s no hot water and a shared bathroom. Always ask what comes with that rate before you celebrate.

Ignoring Mortgage Insurance

Credit: bongkarngraphic

Paying less than 20% down? Mortgage insurance is likely in your future, whether you like it or not. Many buyers overlook this extra cost, but it can sneakily add hundreds per month to your payment. And PMI can stick around for years, so always ask when it drops off and what it’ll cost you each month.

Opening New Credit Accounts

Credit: Getty Images

You might think opening a new credit card or store account won’t matter much, but lenders notice. Each inquiry can bump your score down and raise red flags. It may be harmless once, but it adds up quickly and can mess with the final results.

Not Shopping Around

Credit: Getty Images

Settling for the first lender you talk to is like buying the first car you test drive without checking anything else—it might work out, but the odds aren’t in your favor. Spend some time shopping, and your wallet will thank you.

Overlooking Closing Costs

Credit: Canva

The loan terms might sound decent until those sneaky closing costs roll in and throw off your whole budget. From appraisal fees to title insurance, they can total up to 5% of the home price. That’s not a small change. Always ask for a loan estimate early so you know what you’re signing up for.

Misjudging Loan-To-Value Ratio

Credit: Canva

Focusing only on home price and ignoring your loan-to-value ratio is like baking a cake and forgetting the oven. Lenders care a lot about that number because it tells them how risky you are. The lower your ratio, the better your interest rate. A bigger down payment can lower it and make everything else somewhat easier.

Adding Excessive Debt

Ctedit: Canva

Lenders take notice when you’re piling on credit card charges or financing big-ticket items before closing—and not in a good way. It messes with your debt-to-income ratio, which affects your approval and rate.

Underestimating Homeownership Costs

Credit: Getty Images

If you think your mortgage is the only bill coming your way, brace yourself. Property taxes, insurance, maintenance, and even the occasional roof repair all want a piece of your paycheck. More than a monthly payment. It’s a whole lifestyle shift.

Skipping Home Inspection

Credit: Getty Images

For anyone tempted to skip the inspection to speed things up—don’t. You might be walking into a money pit with plumbing problems, faulty wiring, or worse. A home may look great online, but real-life surprises are expensive. Things get ugly once the keys are yours.

Delaying The Process

Credit: pexels

Are you waiting too long to lock in a rate or send in paperwork? That can throw off your entire timeline. Rates can rise overnight, and lenders don’t love dragging things out. Things won’t go as smoothly as they could’ve.

Neglecting Credit Score

Credit: Getty Images

Your credit score is your golden ticket to better mortgage deals. If you haven’t looked at it in a while, now’s the time. Borrowers with higher scores can save thousands over the life of a loan. You’d check the price tag on a car, right? Same deal here.

Overlooking Loan Terms

Credit: Getty Images

For anyone zeroing in on the monthly payment without reading the loan details, slow down. Loan terms decide how much you’ll pay over time. A 30-year mortgage with a lower rate might still cost more than a shorter-term loan. The details matter.

Not Asking for References

Credit: studioroman

Lenders talk a big game, but how do they treat real people during the mortgage process? That’s what references are for. Ask your realtor or other buyers who’ve worked with them. If they get weirdly defensive about it, that’s a clue.