15 Brutal Cost-Cutting Lessons From People Who Survived the 2008 Recession

The 2008 financial crisis upended lives overnight—jobs disappeared, savings shrank, and uncertainty became the norm. But some people didn’t just endure it—they adjusted. They cut back, changed spending habits, and found ways to move forward. These are real-world strategies born out of pressure, offering a blueprint for handling economic stress with clarity and grit.

Revive Your Ride

Credit: flickr

With gas prices hitting $5 a gallon during the 2008 recession, one person ditched their car and brought an old Schwinn mountain bike back to life. Swapping out the tires, adding fenders, and building a cargo trailer turned it into a reliable, all-weather ride for errands and commuting.

Choose Pay Cut Over Layoffs

Credit: Pexels

A union worker with seniority was given a choice: take a 10% pay cut or watch coworkers get laid off. They chose the cut. The family trimmed extras, swapped takeout for home-cooked meals, and leaned on public transit to save money. It wasn’t easy, but the steady paycheck brought consistency in a chaotic time.

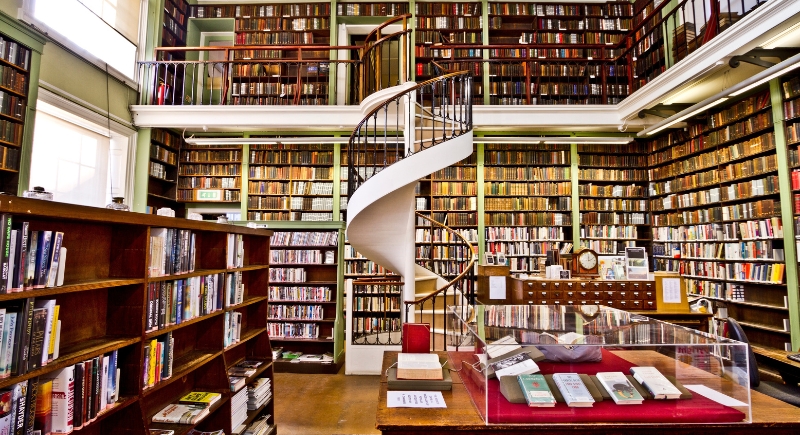

Embrace Free Entertainment

Credit: pixabay

A week after buying a home, the 2008 recession pulled the rug out from under a new homeowner. Jobs vanished, and rebuilding took years. But instead of folding, they shifted gears. Libraries became go-to spots for books and movies, and five-dollar pizzas kept dinner doable. Tight budgeting turned into a quiet challenge, and each small win mattered.

Consolidate Debt

Credit: Getty Images

Amid the chaos of the 2008 recession, one person found themselves buried under five separate loans, each with its own rules, rates, and deadlines. The stress was constant. Instead of drowning in the mess, they made one smart move: consolidating everything into a single payment. That shift brought immediate relief.

Swap Takeout for Staples

Credit: SeventyFour

As the 2008 recession rolled in, one household swapped takeout for sack-sized staples. They built meals around weekly grocery flyers, homemade coffee replaced café stops, and budgeting became a monthly ritual. Every dollar had a job. They tackled transportation, too, joining a rideshare to cut fuel costs and swapping solo drives for public transit.

Focus on Routine and Creativity

Credit: Getty Images

One parent kept things steady at home despite a tight budget. By focusing on routine, creativity, and time together, they gave their child a grounded, happy upbringing. The experience showed that stability doesn’t require spending, and some of the best memories come from the basics.

Live Modestly in Freelance

Credit: Getty Images

Long before the 2008 recession shut down gigs and dried up paychecks, one entertainment worker had already dialed in a strategy for financial stability. They lived modestly, knowing that freelance work doesn’t come with guarantees. That discipline paid off. As jobs disappeared across the industry, they stayed afloat without piling on debt.

Work in Recession-Proof Fields

Credit: SeventyFour

During the 2008 recession, most sectors took a hit—but not all. Professionals serving wealthy clients in luxury services, high-end real estate, or niche consulting often stayed busy, while others scrambled. This path showed the advantage of working in fields less tied to the broader economy. By focusing on markets that hold steady under pressure, some managed to keep income flowing.

Pivot to Safety Then Re-enter

Credit: Getty Images

As markets crashed and asset values nosedived in 2008, one investor made a clean pivot—pulling funds out of the chaos and locking them into Certificates of Deposit. Later, with the economy stabilizing and confidence returning, they moved back into the market. Sometimes, playing it safe is the most brilliant move in the room.

Seek Jobs in Essential Industries

Credit: Getty Images

Essential industries don’t flinch much during economic storms. Healthcare, utilities, and public safety keep moving, because people still need care, power, and protection no matter what’s happening on Wall Street. Jobs in these sectors tend to hold steady, offering a level of security that’s hard to beat during a downturn.

Cut Extras and Get Creative

Credit: Getty Images

As the economy slid, one family tightened their budget and got creative. They cut out extras, grew their vegetables, and stuck to discount stores. Dinner was driven by what was already in the pantry. Free local events replaced costly nights out. By working together, they saved money and built a rhythm rooted in teamwork, not sacrifice.

Downsize Home and Transportation

Credit: Monkey Business Images

As their business income plunged from $100,000 to $25,000 during the 2008 recession, one family gave up their home before credit damage set in and found a $650 rental, well below average rent. Then they swapped their car for a $3,000 used one, cutting payments and insurance costs in one move.

Pause Retirement Contributions Temporarily

Credit: Canva

During the 2008 recession, one working family found itself caught between steady jobs and rising costs. Paychecks stayed the same, but expenses didn’t, so they paused retirement contributions for some time., It was a short-term fix with long-term consequences, but it bought them breathing room when they needed it most.

Cash Out Savings

Credit: Canva

In the middle of the 2008 recession, a single mother in Los Angeles found herself stretched to the edge, raising a newborn on $45,000 a year with no partner support and no family to lean on. She cashed out her 401(k), cooked every meal at home, sold what she could, and walked nearly everywhere to cut transportation costs.

Rely on Savings and Live Lean

Credit: Canva

After two decades in the corporate world, a mid-career professional suddenly found themselves jobless during the 2008 crash. Thanks to steady saving habits and a solid investment cushion, they managed daily expenses using unemployment benefits without sliding into debt. Living solo helped—they kept rent low, cut non-essentials, and stuck to a lean budget.