7 Things the IRS Does if You Refuse to Pay Your Taxes

Ignoring a tax bill can open the door to a string of uncomfortable consequences from the Internal Revenue Service. When taxpayers don’t pay what they owe, the IRS uses tools to collect the money. This is a breakdown of what might happen if you refuse to pay your taxes.

The IRS Sends a Bill

Credit: iStockphoto

First things first: the IRS won’t come knocking without a notice. If you owe money, they’ll mail a bill that clearly outlines what you owe, how much is past due, and what penalties or interest are building up. This initial letter is more of a warning shot than a threat.

Interest Starts Piling Up

Credit: pexels

Every day your balance goes unpaid, interest keeps adding up. The longer it sits, the more it grows. The IRS compounds this interest daily, meaning that even a small tax debt can snowball if ignored. It’s like your credit card debt, but backed by a federal agency.

Late Payment Penalties Kick In

Credit: Canva

On top of interest, they charge a late payment penalty. This is typically 0.5% of unpaid taxes per month, capping out at 25%. So if the debt sits long enough, the penalty alone can be a significant chunk of what you owe—money lost for waiting too long.

Federal Tax Liens Appear

Credit: Getty Images

A tax lien isn’t something that shows up quietly. The IRS can file a Notice of Federal Tax Lien, which claims your property as collateral. This public record alerts creditors that the government has dibs on your stuff if you don’t pay, and it can wreck your credit score.

Your Wages Can Be Garnished

Credit: Getty Images

If you ignore IRS notices long enough, they can contact your employer and garnish your wages. That means a chunk of your paycheck goes straight to them before it hits your account. You don’t get a choice. It’s automatic, and it continues until the debt is fully paid.

Bank Accounts Might Get Frozen

Credit: Canva

The IRS doesn’t need a judge’s permission to dip into your bank account. Through a levy, they can legally take money straight from your savings or checking to cover what you owe. You usually get a final notice, but it’s only 30 days before your funds are at risk.

They’ll Seize Your Refunds

Credit: Getty Images

Expecting a tax refund this year? Not if you have an unpaid balance. America’s revenue service can and will apply any future tax refunds toward your old debt. Instead of getting that check in the mail, it’ll go straight into paying down what you owe from prior years.

You Could Lose Your Passport

Credit: Canva

The IRS now works with the State Department on seriously delinquent tax debts. If you owe $62,000 or more, they can ask for your passport to be revoked or denied. Planning an international trip? A tax issue could leave you grounded until the matter is resolved.

Social Security Payments Shrink

Credit: Canva

Even your retirement benefits aren’t off-limits. The Internal Revenue Service of the United States can levy a portion of your Social Security payments if you’re behind on taxes. They usually take up to 15% of monthly payments, which can really add up for retirees living on a fixed income.

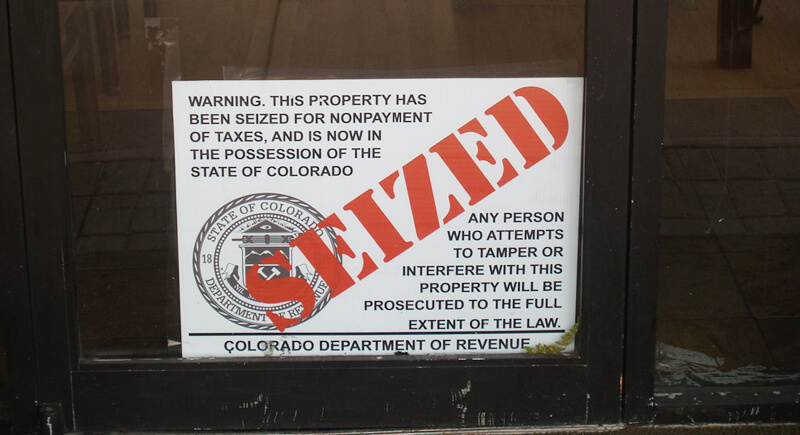

Property May Be Seized

Credit: flickr

This doesn’t happen often, but when it does, it’s serious. The IRS can seize real estate, cars, and other personal property to satisfy large tax debts. They’ll auction off those assets and apply the proceeds to your balance. It’s a last resort, but a real possibility.

Tax Debt Goes to Private Collectors

Credit: pexels

Sometimes the IRS even brings in backup. Your debt might get handed off to a private collection agency. These firms are still working on behalf of the government, and they can be persistent. They don’t have the same powers as the government agency, but the phone calls will keep coming.

You May Face Legal Action

Credit: Canva

If your case involves tax evasion or fraud, the Internal Revenue Service can pursue criminal charges. Jail time is rare and usually reserved for extreme cases, but civil lawsuits or court judgments are very much on the table. That’s when things get even more complicated.

A Levy Can Hit Insurance or Investment Accounts

Credit: Getty Images

Not all levies target your paycheck or bank account because they can tap into life insurance payouts, retirement accounts, and brokerage funds. If you’re a landlord, don’t be shocked if they place a levy on rent payments. Basically, any money stream you control might be vulnerable.

They Can Send a Revenue Officer

Credit: flickr

Even if you go completely silent, the IRS will likely assign your case to a revenue officer. This isn’t a casual visit. It means someone is now personally looking into your finances, and they’ll show up to talk. This step typically signals that collections are becoming more aggressive.

They Won’t Forget

Credit: Getty Images

One of the most unnerving facts? The IRS has a long memory. Tax debts don’t vanish easily. The statute of limitations for collections is 10 years, and during that time, the IRS can keep pursuing you, charging interest, and using tools to collect. Time alone won’t erase the problem.