5 Investments Warren Buffett Regrets—And 5 That Made Him a Legend

Investing always comes with risks—even for someone like Warren Buffett. Over the years, he’s made some brilliant decisions that paid off massively, along with a few that didn’t go as planned. This list closely examines some of his most talked-about wins and missteps.

Best: Coca-Cola

Credit: pexels

In 1988, the Oracle of Omaha invested $1.3 billion in Coca-Cola, securing a 9.3% stake. The stock has delivered remarkable long-term returns, and the dividends now generate over $700 million annually. Warren’s love for Cherry Coke made this a rare combination of personal taste and professional brilliance.

Best: Apple

Credit: flickr

When Warren Buffett made his first investment in Apple in 2016, he saw it not just as a tech company, but as a consumer product leader. That perspective shift paid off. The stake, which once exceeded $170 billion in value, made Apple the most significant single holding in Berkshire Hathaway’s portfolio for several years.

Best: GEICO

Credit: flickr

The investor began purchasing GEICO stock in the 1970s and bought it outright in 1996. GEICO’s cost-effective business model and steady underwriting profits provided a vital insurance float that helped fuel Berkshire’s growth.

Best: American Express

Credit: flickr

Warren bought into American Express during a turbulent time in the 1960s. Decades later, that vote of confidence has been rewarded many times over. Berkshire now holds a stake worth over $28 billion. Thanks to compounding value and strong brand performance, it hasn’t added a single share since 1995.

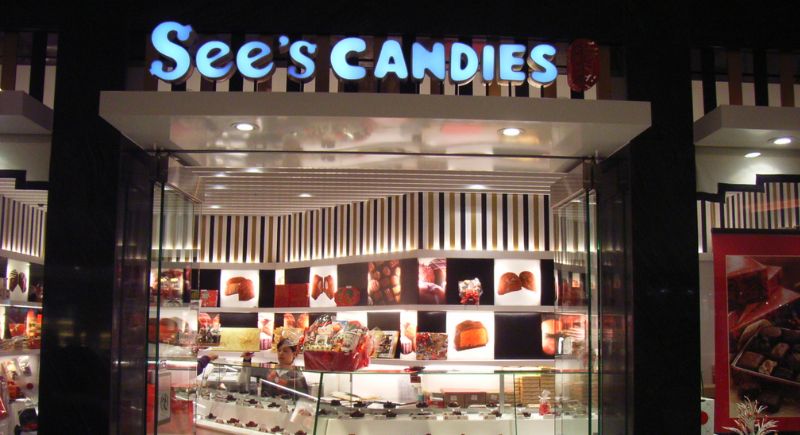

Best: See’s Candies

Credit: Wikimedia Commons

Purchased in 1972 for $25 million, See’s Candies was a turning point in Warren’s investing strategy. The small West Coast chain showed the value of pricing power and customer loyalty. The business has since delivered over $2 billion in profit, while remaining true to its original identity.

Best: BYD

Credit: Wikimedia Commons

In 2008, Warren invested $232 million in Chinese electric automaker BYD after Charlie Munger championed the idea. BYD eventually became a global EV leader. Berkshire’s stake surged in value to over $9 billion.

Best: Bank of America

Credit: Wikimedia Commons

During market uncertainty in 2011, the Oracle of Omaha injected $5 billion into Bank of America. He structured the deal with preferred shares and warrants that were later converted into common stock. That decision turned into a multibillion-dollar position with ongoing dividends.

Best: Berkshire Hathaway Energy

Credit: Instagram

Warren acquired MidAmerican Energy in 2000 for $2.1 billion and later rebranded it as Berkshire Hathaway Energy. The utility business has consistently delivered strong profits, adding $3.7 billion to earnings in 2024 alone. Its long-term, asset-heavy nature fits well with the investor’s preference for stability and steady returns.

Best: National Indemnity

Credit: Wikimedia Commons

In 1967, the investor purchased National Indemnity for $8.6 million. The move helped launch Berkshire’s powerful insurance division. Through disciplined underwriting and the accumulation of float, the company gave Warren the firepower to invest in larger and more complex deals for decades to come.

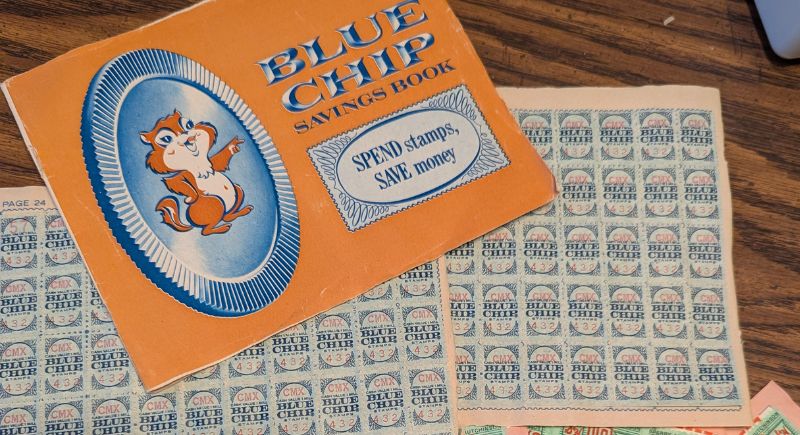

Best: Blue Chip Stamps

Credit: Reddit

Warren and Charlie Munger gained control of Blue Chip Stamps in 1970. Though the trading stamp business faded, its cash flow was used to purchase businesses like See’s Candies and Wesco Financial. It became an early example of how reinvested earnings can fund long-term, high-quality growth.

Worst: Dexter Shoe

Credit: Facebook

In 1993, Warren acquired Dexter Shoe for $433 million using Berkshire stock. The business quickly became obsolete, and the shares given away in the deal would be worth billions today. The investor often cites it as one of his most painful blunders—not just for the money but also for the lesson.

Worst: Berkshire Hathaway (Textiles)

Credit: X

Warren originally bought Berkshire Hathaway stock as a retaliation against management’s lowball offer. The textile operation was in decline, and the business struggled for years. Though the name stayed, he’s called it a poor use of capital and admitted the manufacturing losses held the company back in its early years.

Worst: Tesco

Credit: flickr

The Oracle of Omaha built a sizable stake in UK grocery chain Tesco but waited too long to exit. In 2014, a profit overstatement scandal rocked the company, and Berkshire suffered a $444 million after-tax loss. Warren called the delay a mistake and admitted he should have acted faster.

Worst: Amazon

Credit: Canva

Despite praising Jeff Bezos, Warren never bought Amazon early on. He misunderstood the scale and durability of its business model, especially in cloud services and e-commerce. In hindsight, he’s described this as a missed opportunity—one that could have generated enormous gains had he acted on his instincts.

Worst: IBM

Credit: Wikimedia Commons

From 2011 to 2017, the investor committed over $10 billion to IBM, betting on a turnaround in cloud and AI. However, IBM lagged behind competitors like Microsoft and Amazon. Warren gradually exited the position, admitting that his thesis on the company’s long-term value didn’t pan out as expected.

Worst: ConocoPhillips

Credit: flickr

Warren made a large investment in ConocoPhillips in 2008 just before oil prices collapsed. The timing was unfortunate, and the company’s performance didn’t match expectations. He even admitted that he misjudged the impact of volatile commodity pricing on the business’s long-term value.

Worst: USAir

Credit: Wikimedia Commons

In 1989, Warren invested $358 million in USAir through preferred shares. The airline’s operational troubles and tight margins made it a challenging hold. Although he eventually recouped most of the money, the investor often points to this as a reminder of the difficulties in capital-heavy, low-margin industries.

Worst: Salomon Brothers

Credit: Reddit

The investor took a major stake in Salomon Brothers, a leading investment bank. When a trading scandal emerged in 1991, he stepped in as interim chairman. Though he helped rescue the firm, the experience showed how reputational risk and internal culture can derail even prestigious financial institutions.

Worst: Missing Walmart

Credit: Wikimedia Commons

Warren once considered buying 100 million shares of Walmart but hesitated. That moment of indecision proved costly, as the stock went on to deliver massive returns. He’s described the situation as “sucking his thumb” and often uses it as a cautionary tale about overthinking and missing clear opportunities.

Worst: Wells Fargo

Credit: Wikimedia Commons

The investor had held Wells Fargo stock for years but began selling shares following a series of scandals tied to fake accounts and governance issues. He exited the position entirely. While the decision aligned with Berkshire’s ethical standards, Warren admitted the timing left money on the table as shares recovered.