10 Industries Hit Hardest by Recent Tariff Changes

You know that moment when you’re shopping and think, Wait, wasn’t this cheaper last year? Yeah, tariffs might be the reason. They’ve been quietly messing with prices and putting pressure on entire industries. Here’s a rundown of the sectors getting squeezed the hardest.

Pharmaceuticals

Credit: Getty Images

Trade barriers on foreign medical components have nudged costs for U.S. drug manufacturers. Since many active pharmaceutical ingredients (APIs) are sourced from overseas, new trade barriers could limit supply, lead to price hikes on medications, and ultimately affect access to critical medications for consumers and healthcare providers.

Electronics Manufacturing

Credit: flickr

U.S. electronics production is under pressure due to import duties on components like circuit boards and microchips, many of which are imported from Asia. The escalating production costs are often passed to buyers, meaning smartphones, laptops, and household gadgets could become noticeably more expensive in retail.

Agriculture

Credit: pexels

U.S. farmers face steep challenges from retaliatory tariffs, especially on soybean exports. Countries like Brazil are seizing the opportunity to fill the gap by threatening America’s agricultural dominance. At the same time, costs for machinery and fertilizers continue to rise due to tariffs on foreign industrial equipment.

Big Box Retailers

Credit: Wikimedia Commons

Large chains like Walmart preemptively warn customers about likely price increases on household goods. Import duties on bulk goods mean common products—from paper towels to canned goods—may soon cost more. The shift could drive shoppers toward local or alternative retailers, affecting billions in revenue across the industry.

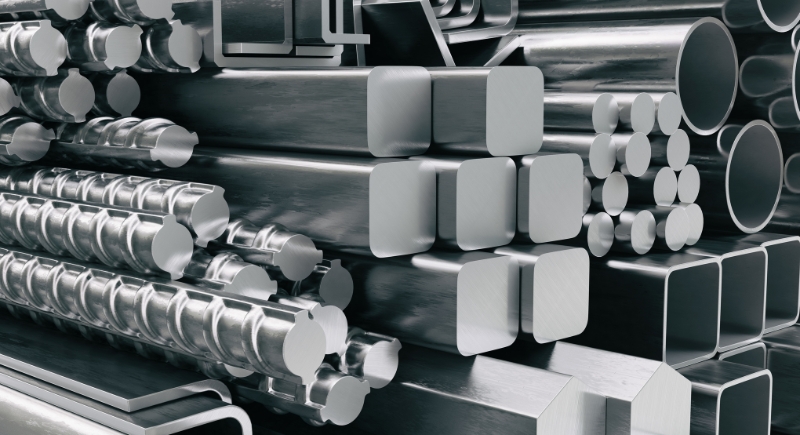

Steel and Aluminum

Credit: Canva

U.S. tariffs on foreign steel and aluminum have made it costlier for domestic businesses to operate. Sectors like automotive and construction now face steeper bills for materials, prompting slower project timelines, slimmer margins, and rising prices on everything from kitchen appliances to commercial buildings.

Fashion and Apparel

Credit: pixabay

A major chunk of American clothing is imported from low-cost producers like China and Vietnam. New import duties, with rates as high as 60%, have increased wholesale costs. Consumers will likely see price tags climb, particularly for items like shoes, basic apparel, and seasonal fashion lines that rely heavily on overseas sourcing.

Automotive Industry

Credit: Getty Images

The car industry is caught in a tariff trap, with price hikes looming over everything from foreign engines and parts. Depending on the origin, new tariffs could push sticker prices up by $4,000 to $7,000, making it harder for consumers to afford new vehicles and for manufacturers to compete globally.

Technology Sector

Credit: freepik

From processors to lithium-ion batteries, tech production is deeply intertwined with global supply chains. Trade barriers on crucial imports have caused input prices to swell, which slows innovation and raises retail costs. Companies also face logistical headaches as they rethink manufacturing locations to sidestep ongoing trade friction.

Renewable Energy

Credit: Getty Images

Clean energy efforts could take a hit as import duties on solar and wind components raise costs for U.S. developers. Analysts estimate that onshore wind projects alone could see a 7% cost increase. These tariffs could delay progress toward sustainability goals and alter the pricing structure for clean energy consumers.

Plastic and Packaging

Credit: Canva

The U.S. imports vast amounts of raw plastic and packaging materials from Canada and Mexico. When tariffs are imposed on these imports, the ripple effects hit industries ranging from food to retail. Businesses face tough choices: absorb the added expense or pass it on to customers via higher prices.

Chemical Industry

Credit: Getty Images

America’s chemical sector is particularly exposed to trade tensions, as hundreds of chemicals are sourced globally. Tariffs affect base materials and specialty compounds, inflating production costs across the board. These pressures are then reflected in everything from automotive coatings to everyday household products.

Aerospace Industry

Credit: Canva

The U.S. aerospace industry—anchored by giants like Boeing—faces international backlash through EU counter-tariffs. These could escalate aircraft costs by 10–15%, impacting competitiveness against Airbus. Lost contracts, especially in Asia and Europe, could cost the U.S. billions and threaten its long-held dominance in commercial aircraft manufacturing.

Industrial Equipment

Credit: Getty Images

Agriculture, mining, and manufacturing all rely on heavy-duty machinery, much of which is imported or built from foreign parts. Tariffs on these products drive up machinery costs by as much as 20%. Domestic manufacturers and farmers are now budgeting more for equipment replacement and upkeep.

Telecommunications Equipment

Credit: pixabay

U.S. telecom firms depend on imported gear from Nokia, Ericsson, and other global suppliers to build and upgrade networks. Tariffs pushing costs by 10–15% could slow 5G rollouts and increase monthly service charges. While some hope for accelerated domestic innovation, the short-term effect is mainly financial strain.

Mineral Oils and Fuels

Credit: Getty Images

Energy trade with Canada is a cornerstone of U.S. fuel supply, but recent tariffs could shift that dynamic. A 10% tariff on Canadian oil would mean higher gas prices for drivers and rising household heating bills. Even a few cents per gallon add up quickly over a year.