10 Millionaires and Billionaires Who Lost Their Fortunes Overnight

Billionaires are often seen as untouchable when it comes to money, but the stock market doesn’t play favorites. In just one trading day, these giants have lost billions as investors quickly pulled back their investments. Disappointing earnings, slowing cloud growth, and cautious AI forecasts triggered a sharp sell-off that affected the wealthiest individuals globally. It shows how quickly fortunes can change when confidence in the future begins to erode.

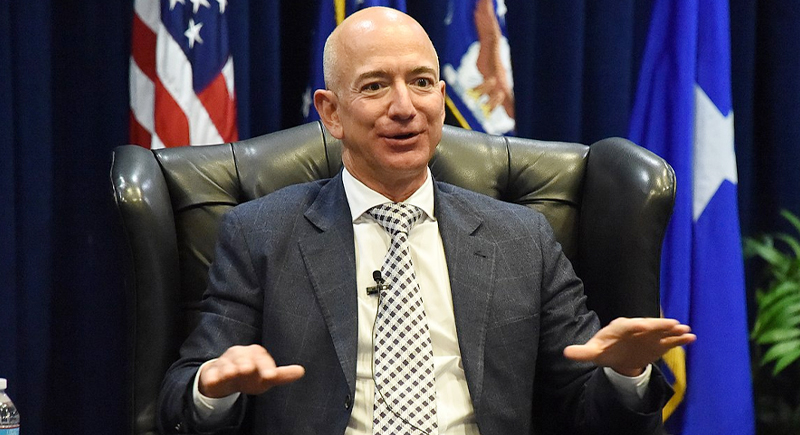

Jeff Bezos

Credit: Wikimedia Commons

Amazon’s stock plunged nearly 9% after executives emphasized long-term AI plans instead of immediate profits. The move spooked investors already wary of tech valuations, and Bezos’s net worth dropped $15.8 billion.

Elon Musk

Credit: Wikimedia Commons

Between July 31 and August 2, Musk’s net worth declined from $252 billion to $235 billion. Tesla’s earnings miss, along with signs of slowing AI enthusiasm, contributed to the shift. It was the most considerable wealth loss among any billionaire during the drop.

Larry Ellison

Credit: Wikimedia Commons

Oracle’s stock spiked for a moment and gave Ellison a temporary $3 billion gain, but the surge faded the next day, and the stock continued to fall. His resulting $6 billion drop in net worth coincided with investor worries about how quickly Oracle is spending on cloud infrastructure and AI.

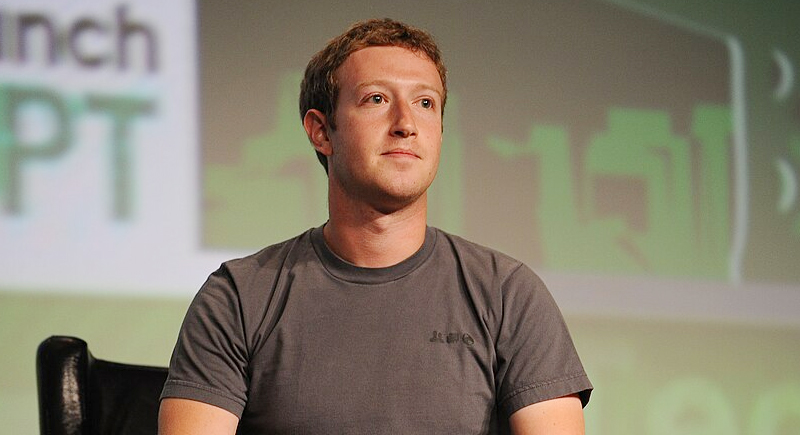

Mark Zuckerberg

Credit: Wikimedia Commons

Mark Zuckerberg, Meta’s founder, lost over $3 billion as part of a broader decline in tech stocks. The drop followed concerns about inflated valuations in the AI sector and a broader shift in investor expectations around tech profitability.

Sergey Brin

Credit: Wikimedia Commons

Alphabet’s ad business didn’t meet expectations, especially on YouTube. The shortfall rattled investors and dragged down the stock, which knocked more than $3 billion off Brin’s net worth. The dip showed how even core businesses like advertising weren’t enough to buffer fears around slowing growth across Alphabet.

Larry Page

Credit: Wikimedia Commons

Page, heavily invested in Alphabet like Brin, suffered a parallel loss as the company’s earnings fell short of expectations. Weak ad returns and slowing AI monetization weren’t the only issues; analysts also flagged broader revenue concerns. His holdings tracked the drop closely and resulted in another multibillion-dollar paper loss.

Francis Ford Coppola

Credit: Wikimedia Commons

All it took was one bad bet. Coppola poured $27 million into One From the Heart, expecting a hit. The movie barely scraped in $4 million, and just like that, he was drowning in nearly $100 million in debt. Filing for bankruptcy was the only option. He bounced back (sort of) by shifting into wine and boutique hotels.

Willie Nelson

Credit: Wikimedia Commons

Willie owed the IRS everything. A $16.7 million tax bill led to federal agents swarming his ranch in 1990. They took almost everything but his guitar, which his daughter had mailed to him in Hawaii just in time. He paid the debt off by releasing an album literally called The IRS Tapes.

Mike Tyson

Credit: Wikimedia Commons

At his peak, Tyson was cashing checks that could buy small islands. But by 2003, it all vanished. He filed for bankruptcy with $23 million in debt. The bills included mansions, legal fees, and a $9 million divorce settlement. He even owed millions in taxes. Years later, he called himself a “broke heavyweight,” and meant it.

MC Hammer

Credit: Wikimedia Commons

For a while, Hammer lived like Silicon Valley’s most prominent VC, only his startup was himself. A $33 million fortune melted fast when he put 200 people on payroll, bought thoroughbred horses, and ran a monthly burn rate that would scare a hedge fund. By 1996, he filed for bankruptcy and owed over $10 million.