The First Billionaires of Every Major Industry

The first billionaire in any industry usually shows up after someone figures out how to control the unglamorous parts of the business, including supply chains, contracts, and pricing power. Looking at who crossed the billion-dollar line first reveals how money actually accumulates once an industry matures and rewards control over visibility.

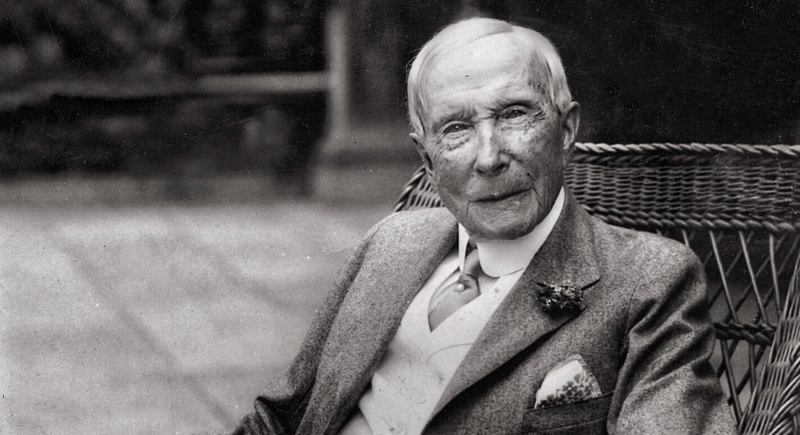

Oil — John D. Rockefeller

Credit: Wikimedia Commons

Rockefeller made his fortune by stabilizing an industry. Instead of chasing oil wells, he focused on refining, rail transport, and long-term supply contracts. By locking in lower costs and predictable pricing, Standard Oil squeezed competitors who relied on speculation. When Rockefeller became a billionaire in 1916, it capped decades of methodical control over how oil moved.

Cryptocurrency — Cameron Winklevoss and Tyler Winklevoss

Credit: Wikimedia Commons

Back when Bitcoin was still dismissed as an internet experiment, the Winklevoss twins treated it like a long-term asset. They accumulated large holdings early, then waited as exchanges made access easier for the public. Wealth came first from holding scarcity, then from building Gemini.

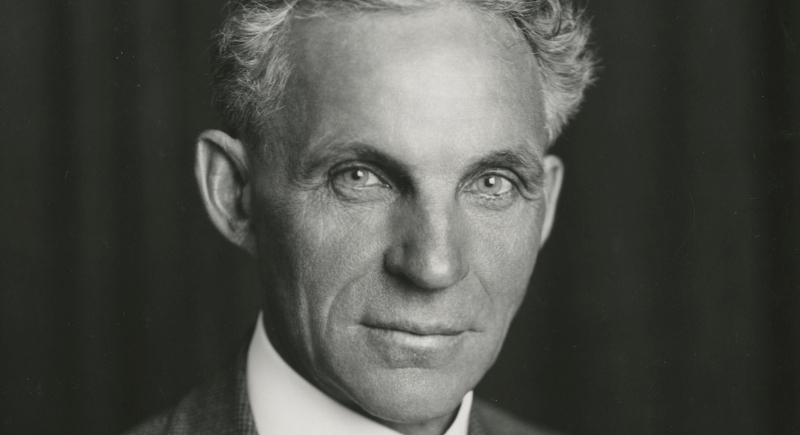

Automobiles — Henry Ford

Credit: Wikimedia Commons

At the start of the 20th century, cars were expensive novelties owned by hobbyists and the wealthy. Henry Ford changed that by reorganizing factories around speed and repetition. Once cars became affordable to ordinary workers, sales exploded. Ford’s wealth followed only after that system scaled nationwide.

Software — Bill Gates

Credit: Wikimedia Commons

Early personal computers shipped incomplete, which created an opening most people missed. Bill Gates realized the real money sat in the software every machine needed to function. Microsoft’s operating systems were licensed to manufacturers rather than sold outright, so each new PC automatically expanded revenue. As computers entered homes, schools, and offices, that licensing model multiplied.

Retail Internet — Jeff Bezos

Credit: Wikimedia Commons

In Amazon’s early years, Jeff Bezos invested heavily in warehouses, fulfillment centers, and delivery systems, while competitors pursued short-term profits. Books were just the entry point. Control over logistics came first. Once fast shipping and inventory depth became expectations, rivals struggled to keep up. Bezos crossed the billionaire status only after that infrastructure worked to Amazon’s advantage.

Social Media — Mark Zuckerberg

Credit: Wikimedia Commons

Facebook didn’t need subscriptions or premium features to mint a billionaire. What it needed was momentum. Mark Zuckerberg became a billionaire in 2008 as Facebook spread through colleges, workplaces, and families faster than competitors could react. Every new user made the platform harder to leave, and advertising followed attention.

Luxury Goods — Bernard Arnault

Credit: Wikimedia Commons

Bernard Arnault built his fortune by assembling heritage brands under a single corporate structure while preserving their identities. By scaling ownership instead of production, Arnault showed that exclusivity can expand globally without losing its grip on demand.

Sports Branding — Michael Jordan

Credit: Wikimedia Commons

Michael Jordan’s salary never made him a billionaire. His name did. The Jordan Brand turned athletic performance into long-term equity. Even after retirement, revenue continued to flow. Jordan’s wealth marked a shift in sports economics, in which athletes stopped renting their image and began controlling it.

Music — Taylor Swift

Credit: Wikimedia Commons

For decades, music wealth flowed toward labels rather than performers, but Taylor Swift reversed that by prioritizing control over recordings, touring logistics, and fan distribution. The Eras Tour generated over $1 billion in revenue.

Creator Platforms — MrBeast

Credit: Wikimedia Commons

By the time YouTube creators were chasing ad rates, MrBeast was already building a supply chain. His videos act as traffic engines that funnel viewers toward food brands, sponsorship deals, and large-scale production operations. His money compounds because the audience is owned, repeatable, and redirected into businesses designed to outlive any one platform.