10 Sneaky Finance Tricks Car Dealerships Use to Boost Profits

You expect the back office to be where the paperwork gets signed. For dealerships, it’s where the money is made. Many of the priciest tricks don’t happen during the test drive. They happen when you’re seated across from someone, pointing at numbers on a screen.

Here are some tactics that inflate your total cost in ways most buyers never catch.

Fixating on Monthly Payments

Credit: Canva

Dealers often ask how much you want to spend each month and then adjust the rest of the deal to match. By stretching your loan over 72 or 84 months, they’ll keep the payment low, while collecting far more in interest over time. The car might feel affordable, but the long-term cost balloons.

Bundling Trade-In and Purchase

Credit: Getty Images

Dealers prefer to handle trade-in values, purchase price, and financing as one blended transaction. It makes it hard to track what’s really going on. They might give you more for your old car, then subtly inflate the price of the new one.

Adding Extras Without Permission

Credit: iStockphoto

If your contract lists things like tire protection, key fob insurance, or window etching, and you don’t remember saying yes, you probably didn’t. These high-margin extras are often slipped in by default. They’re rarely required, and you have every right to decline anything you didn’t agree to upfront.

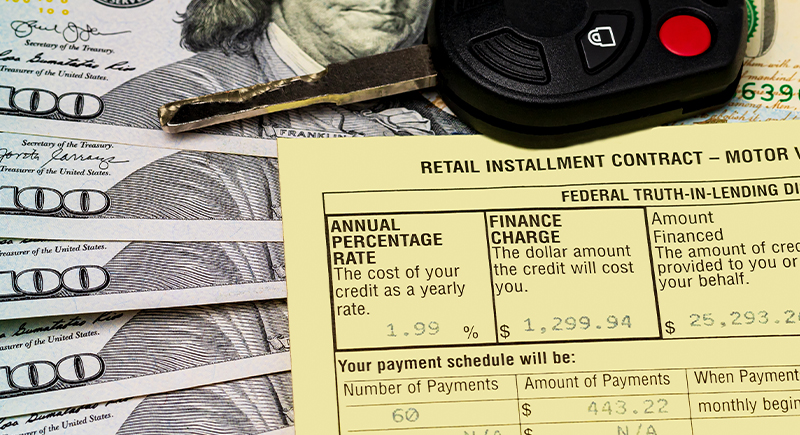

Interest Rate Padding on Loans

Credit: iStockphoto

Just because a dealership shows you a 7% rate doesn’t mean that’s what the lender offered. Dealers often secure loans at lower rates, then mark them up and pocket the difference. It’s legal and common. Coming in with a pre-approved loan can put you in control of what you actually pay to borrow.

“Yo-Yo” Financing Traps

Credit: Getty Images

This trick, known as “yo-yo” financing, starts with you taking the car home before financing is finalized. A few days later, you’re told there was an issue and asked to return, but only now are the terms worse. Don’t drive away until everything is signed and confirmed in writing.

The Four Square Shuffle

Credit: Canva

The “four square” sheet breaks down the deal into price, down payment, trade-in, and monthly payment. But it’s a tactic to shift numbers between boxes while you focus on just one, usually the monthly payment. It creates the illusion of a good deal, even if you’re losing money somewhere else in the structure.

Unapproved Preinstalled Add-Ons

Credit: Canva

Some vehicles on the lot come with dealer-installed items, like VIN etching, nitrogen tires, or paint protection, that weren’t disclosed upfront. These often appear in your final paperwork without any prior mention. If these weren’t part of your original deal, request they be removed before you sign.

Overpriced Package Bundles

Credit: freepik

Later in the financing process, you might be pitched “convenience” or “protection” packages containing items like floor mats, alarms, or extended maintenance. These bundles often come with vague pricing and poor value. Because they’re presented late, many buyers accept them just to avoid restarting the negotiation process.

Manipulating Lease Money Factors

Credit: iStockphoto

In leasing deals, dealers calculate interest using a figure called the “money factor.” Many buyers don’t understand this figure or even know it exists. Dealers can inflate this number to boost their profits. Ask to see the money factor and convert it to an APR—multiply it by 2,400—to check for fairness.

Lowball Trade-In Offers

Credit: pexels

Most dealers start by pitching a trade-in offer far below what your car’s actually worth. They’re counting on buyers to come prepared with numbers for the new car, but not the old one. If you haven’t checked market value in advance, you’ll likely get shortchanged. Bring your own research and don’t settle for their first number.

Rolling Debt Into New Loans

Credit: iStockphoto

If you still owe money on your trade-in, the dealership might say they’ll “handle it”. But often, they just fold that balance into your new loan. This increases your total loan amount and monthly payment, sometimes without making it obvious.

Bait-and-Switch Advertising

Credit: freepik

Some ads show attractive deals on specific vehicles, but once you arrive, you’re told that the car has been sold. A more expensive option is then offered. Dealers count on your willingness to stay after making the trip. Calling ahead and asking for written confirmations can help avoid wasting time.

Add-Ons Framed as Tiny Monthly Costs

Credit: iStockphoto

Even when extras are mentioned, they’re often presented as minor monthly bumps—$25 here, $35 there. Spread over a 72-month loan, that adds up to thousands. Dealers know buyers are more likely to agree to extras if they’re framed this way.

Last-Minute Surprise Fees

Credit: Getty Images

Fees like documentation, preparation, or market adjustments are sometimes inserted right before you sign. Some are legitimate, but many are just revenue padding. Ask for a full breakdown before you agree to anything, and be ready to walk if unexplained charges suddenly appear.

Extended Warranties on Leases

Credit: Getty Images

Lease a car and you’ll likely be covered under the manufacturer’s warranty for the full lease term. Still, some dealers try to sell you an extended warranty anyway—one that overlaps entirely with your existing coverage. These products are expensive, often nonrefundable, and unnecessary for most lease situations.