10 People Expected to Become the World’s First Trillionaires

Reaching a trillion dollars in personal wealth once sounded impossible, yet several of today’s richest figures are already moving in that direction. Their fortunes are growing alongside industries like artificial intelligence, space technology, and luxury goods, creating a pace of wealth accumulation the world has never seen before. If these trends continue, a small group of individuals could become the first people in history to cross the thirteen-digit mark. Here are the ones most analysts expect to get there first.

Elon Musk

Credit: Wikimedia Commons

Elon Musk holds major stakes in Tesla, SpaceX, and xAI, and he remains the closest contender for trillionaire status. Oxfam and Informa Connect project that he could reach the trillion-dollar mark as early as 2027. Some analysts also believe his current political relationships may strengthen his businesses and support the rapid rise in wealth.

Gautam Adani

Credit: Wikimedia Commons

India’s Gautam Adani has had a volatile few years, but when his empire bounces, it bounces hard. After a dramatic recovery from stock shorting scandals, Adani’s net worth surged past $75 billion. Informa’s report ranks him second-most likely to hit trillionaire status, thanks to a staggering 123% average annual wealth growth rate.

Jensen Huang

Credit: Wikimedia Commons

Huang’s fortune soared as Nvidia became the go-to chipmaker for AI development, gaming, and enterprise computing. In 2017, his net worth hovered around $3 billion. By 2024, it exploded past $117 billion. At this pace, Informa Connect sees Huang reaching a trillion by 2028.

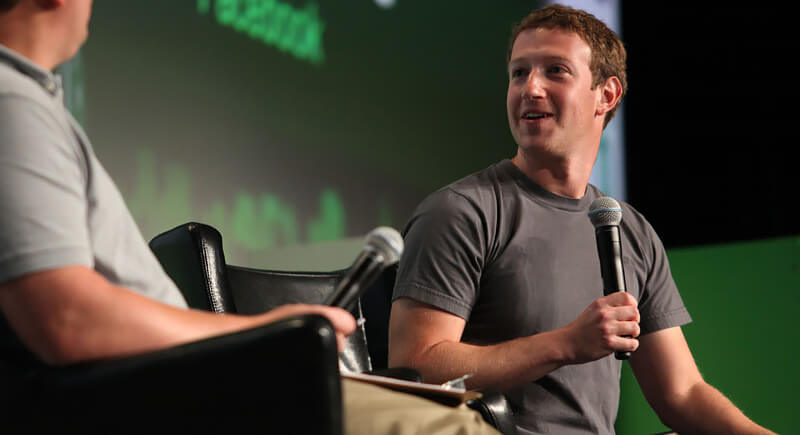

Mark Zuckerberg

Credit: Wikimedia Commons

Mark Zuckerberg shifted focus away from heavy Metaverse spending and placed more attention on advancing AI, which helped Meta’s stock recover sharply. His wealth rose from $138 billion to more than $217 billion within a year as a result. New generative AI tools like Llama and the growing use of AI features in products such as Ray-Ban smart glasses and Quest headsets have kept investor confidence strong.

Bernard Arnault

Credit: Wikimedia Commons

The chairman of LVMH has long ruled the luxury world, and his family’s wealth continues to climb. He controls roughly half of a group that spans drinks, fashion, and jewelry, from Veuve Clicquot to Tiffany. According to the Informa Connect projections, Arnault could reach trillionaire territory by 2030.

Prajogo Pangestu

Credit: koniukhchaslau

Pangestu leads Barito Pacific, Indonesia’s top petrochemical group. He ranked 54th in the world in 2024 with a net worth of $31.7 billion, but it’s the growth rate that caught attention. Informa puts him in the top five most likely to reach a trillion, largely due to his aggressive investments in energy and mining.

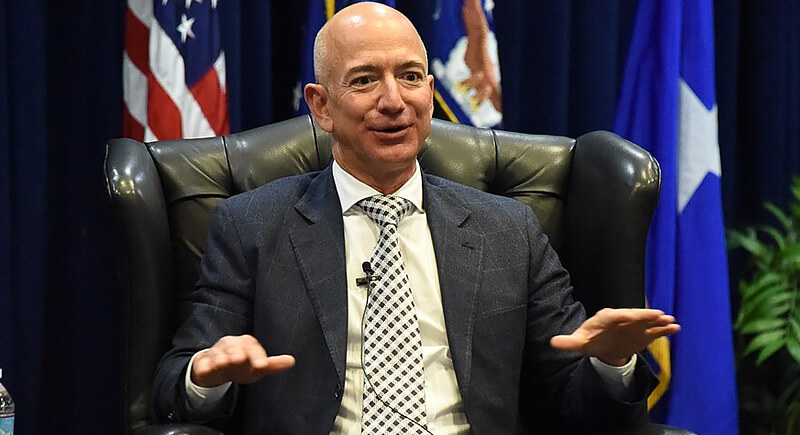

Jeff Bezos

Credit: Wikimedia Commons

Bezos may have stepped down as Amazon CEO, but he’s far from slowing down. With under 10% of Amazon still in his portfolio and new bets in AI and space travel through Blue Origin, his net worth hit $245 billion in 2024.

Larry Ellison

Credit: Wikimedia Commons

Oracle’s cofounder is one of the names Oxfam expects to join the trillionaire conversation within the next decade. His fortune has surged alongside rising interest in artificial intelligence, a trend lifting many longtime tech leaders. CNN lists Ellison among the five individuals likely to hit the trillion-dollar threshold if current trajectories hold.

Steve Ballmer

Credit: Wikimedia Commons

Ballmer continues to benefit from Microsoft’s ongoing momentum in cloud computing and AI. His wealth has grown substantially in recent years, thanks largely to his long-held Microsoft stake and the company’s strong market position. His trajectory still reflects the broader tech-driven surge reshaping global wealth rankings.

Zhang Yiming

Credit: Youtube

As the founder of ByteDance, Zhang built one of the most influential digital platforms of the past decade. He has stepped back from daily leadership, yet his legacy and ownership stake keep him central to conversations about the future of social media, innovation, and private-company valuations.