10 Companies That Successfully Bounced Back After Bankruptcy

Bankruptcy usually signals deep financial failure, but for some companies, it became a turning point. Between legal protection and the chance to restructure debt, several major brands used the process to regroup and re-enter the market. These aren’t just stories about making a comeback, but proof of how companies adapt under pressure.

Marvel Entertainment

Credit: Wikimedia Commons

Before Marvel became a major force in film, it nearly collapsed under the weight of falling comic book sales. In 1996, the company sought protection and had to find ways to survive. It licensed out characters like Spider-Man and the X-Men, which brought in much-needed revenue. Disney saw potential and purchased the franchise in 2009 for $4 billion.

Converse

Credit: Wikimedia Commons

Converse struggled to keep up with growing competition in the early 2000s, following declining sales and rising debt. The brand declared bankruptcy in 2001 and was eventually sold at auction. New leadership helped stabilize its model, but the major shift came in 2003 when Nike acquired Converse for $305 million. The deal gave Converse access to global distribution and marketing power.

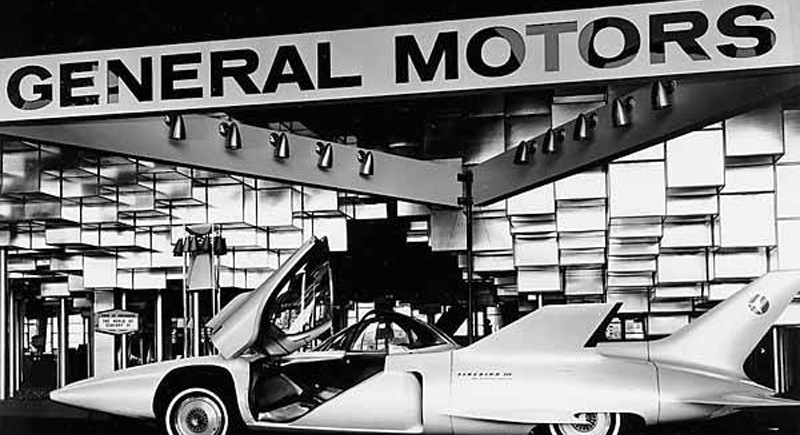

General Motors

Credit: Wikimedia Commons

The company had accumulated more than $30 billion in debt and was struggling to stay competitive. This was when a $50 billion government bailout helped fund a complete overhaul. GM cut brands, reorganized, and made a comeback to public trading the following year. By 2021, it posted $10 billion in net income.

Six Flags

Credit: Wikimedia Commons

High debt levels crushed Six Flags by 2009. At the time, it had taken on more than $2.7 billion in obligations and was unable to manage repayments. The company turned to Chapter 11 and restructured by converting creditors into owners, which wiped out a significant portion of debt. This move gave the firm financial breathing room.

Delta Air Lines

Credit: Wikimedia Commons

Avoiding a government bailout, Delta entered bankruptcy in 2005 and focused on fixing its cost structure. It reduced labor expenses by $1 billion and eliminated 6,000 jobs. The airline then expanded international routes and reduced complexity through its Atlanta hub. After 19 months, Delta exited bankruptcy in 2007 with a more efficient business model.

Hostess

Credit: Wikimedia Commons

The 2012 bankruptcy of Hostess marked what many thought would be the end of Twinkies and other popular snacks. Production stopped, and shelves went empty. But come 2015, a private equity firm acquired the company and invested $375 million to rebuild it. Hostess reduced its product lines, cut overhead, and came back with a leaner operation.

Betsey Johnson

Credit: Wikimedia Commons

After rapid expansion and falling revenue, Betsey Johnson filed for Chapter 11 in 2012. The company closed retail stores and laid off employees. Steve Madden, who had acquired the brand’s licensing, supported its relaunch. Johnson introduced lower-priced designs, focused on retail distribution, and built a stronger e-commerce presence.

American Airlines

Credit: Wikimedia Commons

Bankruptcy gave American Airlines the space to reduce costs and rethink its structure. After filing in 2011, the company used the legal protection to manage debt and streamline operations. In 2013, it merged with US Airways and ended up forming the largest airline in the world at that time. The combined carrier returned to profitability by 2014.

Ashley Stewart

Credit: Instagram

Building its identity around plus-size fashion and a loyal customer base of Black women, Ashley Stewart became a recognizable name in retail. But by 2014, it had closed many stores and had lost investor support. A private equity firm backed its revival, and CEO James Rhee led a digital overhaul.

Hooters

Credit: Wikimedia Commons

Years of declining performance and a weakening brand image led Hooters to file for Chapter 11 bankruptcy in 2025. The corporation had lost its footing in a competitive dining market and needed a major reset. A group that included the original founders stepped in to take control. They aimed to restore the brand’s original concept and streamline business.