50 Most Common Real Estate Terms… and What They Really Mean

The first time you sit down with an agent or lender, it can feel like everyone else has learned a secret code. Words fly around the room—some familiar, most not—and you’re left wondering what they actually mean for your money and your future home.

This list untangles that language so you can follow every step with confidence.

Above Asking

Credit: Getty Images

Sometimes, buyers throw in more money than the listed price in hopes of outshining other offers. For example, a house marked at $300,000 might attract a $310,000 bid. This is a bold move, but it doesn’t seal the deal on its own because sellers weigh conditions and timelines alongside that higher number.

Annual Percentage Rate

Credit: Getty Images

APR is a clearer way to see what a loan truly costs. It bundles interest with lender fees, so those glossy interest rates don’t fool you. A loan that advertises 6.5% could actually land at 6.8% APR once charges are counted.

Appraisal

Credit: Getty Images

A professional appraiser estimates a home’s market value by analyzing comparable sales and condition. Lenders rely on this figure to approve mortgages. When appraisals come in lower than expected, buyers and sellers may need to renegotiate or bring extra cash to closing.

Assumable Mortgage

Credit: Getty Images

Some mortgages allow a new buyer to take over the seller’s existing loan. This can secure a lower interest rate than what’s available in the market. The catch is covering the difference between the loan balance and the home’s price, often through another loan.

Concession

Credit: Getty Images

Sometimes sellers pitch in to help the sale along by covering things like closing costs or a home warranty. These agreements are more common when homes sit unsold longer than expected. It can be a win for buyers who need that financial nudge to complete a purchase.

Contingency

Credit: pexels

A contract might include conditions, like a home inspection, that need to satisfy the buyer before the deal proceeds. These safeguards give room to back out if things aren’t right. Dropping them can make an offer more attractive, but it trims away those safety nets.

Conventional Mortgage

Credit: Getty Images

This loan isn’t backed by a government agency. Buyers typically need stronger credit and a larger down payment than with FHA or VA loans. Many prefer them because they often have fewer restrictions on property types and loan limits.

Debt-to-Income Ratio

Credit: Getty Images

Lenders evaluate monthly debts compared to gross income. A person earning $8,000 a month with $3,000 in debt payments has a 37.5 percent ratio. Lower ratios suggest more capacity to handle new mortgage payments, and thus higher loan approval odds.

Pocket Listing

Credit: Getty Images

Some homes are shopped around without hitting public listings. Sellers might want privacy or a very targeted audience. These deals can feel exclusive, but they limit exposure, which might mean fewer competing offers compared to the open market.

Option Period

Credit: Canva

In some states, especially Texas, buyers can pay for an agreed window of time after signing a contract to investigate the property. They can cancel for any reason in that window without losing earnest money.

iBuyer

Credit: Getty Images

A company that uses tech platforms to make near-instant cash offers on homes. Sellers often get speed and convenience, though offers may be below what a competitive listing would bring. Fees are structured differently from those with traditional agents, so terms need scrutiny.

Natural Hazards Disclosure Report

Credit: Getty Images

Certain regions require sellers to disclose if a home sits in areas prone to floods, fires, or earthquakes. This formal report highlights environmental risks and can guide decisions about insurance costs or future safety measures before committing to a purchase.

Land Lease

Credit: iStockphoto

Not every purchase includes the ground under the house. With a land lease, you buy the structure but pay rent to the landowner. Terms can stretch decades, but increases or lease limits can affect resale value or long-term costs.

Tenancy in Common

Credit: iStockphoto

Two or more people can hold shares of one property, but those shares don’t automatically pass to the others if someone dies. Each owner’s portion goes through their estate, which can create intricate ownership scenarios later. It’s a flexible but detail-heavy structure.

Rent‑Back

Credit: Getty Images

Sometimes sellers need extra time after closing, so they pay rent to the new owner for a set period. Rates and conditions are spelled out in advance. It can smooth out tricky timing issues.

Equity Stripping

Credit: Getty Images

Homeowners sometimes borrow repeatedly against their property’s value to cover debts or expenses. It can provide short-term relief, but too many loans stacked on a single home can lead to serious financial strain or even foreclosure if payments spiral out of reach.

Probate Sale

Credit: Getty Images

When a property owner dies without a clear will, the court may oversee a sale through probate. Buyers often face longer timelines and stricter conditions, and offers typically require court confirmation before moving forward.

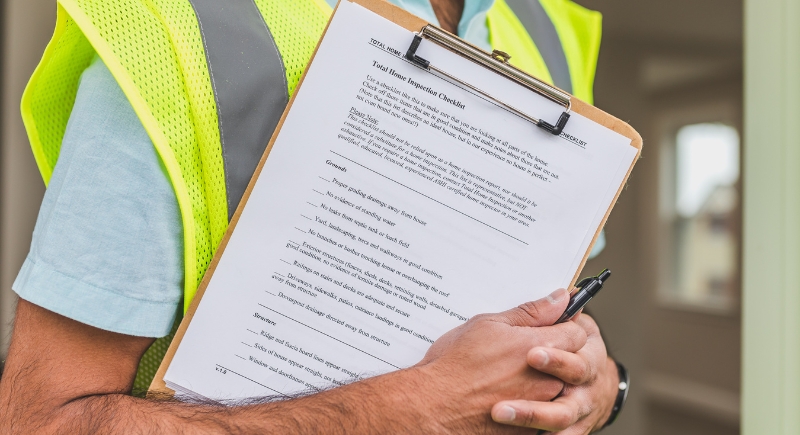

Subject to Inspection

Credit: iStockphoto

Some homes are offered with limited access upfront, often because tenants still live there. Buyers make offers without seeing everything and reserve the right to cancel if the interior reveals problems. It’s a gamble, but sometimes the only way to get in line.

Real‑Estate Owned (REO)

Credit: iStockphoto

After a foreclosure auction fails to attract buyers, the lender takes ownership. These properties are usually sold “as is,” though banks often resolve title issues first. That can make them less unpredictable than some distressed sales, even if they still need repair work.

Easement

Credit: Getty Images

A property might come with someone else’s legal right to use part of it, like a shared driveway or utility lines. These agreements can be helpful or limiting, depending on what’s involved. Reviewing them carefully can prevent future conflicts with neighbors or service providers.

Covenants, Conditions, and Restrictions (CC&Rs)

Credit: pix4free

Developers or HOAs set rules that limit what owners can do with their property. These rules might control fence heights, exterior colors, or pet limits. Violating them can lead to fines or legal action, so they’re worth reading carefully.

Escrow Holder

Credit: Getty Images

This is a neutral third party who manages funds and documents during a transaction. They release money only after all conditions are met and help both buyers and sellers feel secure that no one gets shortchanged before closing.

Preliminary Title Report

Credit: Getty Images

Before finalizing a sale, a title company issues a report showing who legally owns the property and any claims against it. Buyers use this to spot problems like unpaid taxes or hidden liens so they can address them before signing the last papers.

Appraisal Contingency

Credit: Canva

This clause allows buyers to or walk away if the appraisal falls below the agreed price. Without it, they’d need to cover the gap themselves, which can mean unexpected out-of-pocket costs. Many buyers are glad to have this safeguard.

Blind Offer

Credit: Getty Images

A blind offer entails submitting an offer on a property without a prior visit. It happens in fast-moving markets where homes vanish quickly. Buyers rely heavily on photos, virtual tours, and agent insight, and accept the risk of unknown issues.

Hard Money Loan

Credit: Getty Images

Investors sometimes use these short-term, high-interest loans to act quickly on a property. Lenders focus on the property’s value rather than the borrower’s credit. They’re fast and flexible but come with higher costs and tight repayment deadlines.

Trust Sale

Credit: Canva

When a home is held in a living trust, a trustee might handle the sale after the original owner’s death. These transactions are more businesslike, with pricing based on market value rather than personal attachment.

Backup Offer

Credit: Canva

If a primary deal falls apart, a backup offer steps in automatically. It saves the seller from starting over and keeps a hopeful buyer next in line without extra waiting. Buyers use this tactic to stay in play on sought-after properties.

Rate Cap

Credit: Getty Images

Adjustable-rate mortgages can shift over time, but a rate cap limits how high interest can climb at each adjustment and across the life of the loan. This built-in ceiling keeps borrowers from facing extreme payment jumps down the road.

Lien

Credit: iStockphoto

A lien is a legal hold on a property, often because of unpaid taxes, contractor bills, or other debts. Sellers must resolve these before closing. Buyers study title reports to make sure they won’t inherit someone else’s obligations after signing the final paperwork.

Balloon Payment

Credit: Getty Images

Some loans require smaller payments initially, followed by one large payment at the end. Buyers who can’t refinance or pay off the balance face steep risks, so understanding the structure is crucial.

Equitable Title

Credit: Getty Images

Equitable title is the right to obtain full ownership of a property once certain conditions are met, often after a purchase contract is signed but before final closing. It gives buyers certain protections even before they hold the deed.

Deed Restriction

Credit: Canva

This is a limitation written into a deed, like banning commercial use or limiting building height. These restrictions stay with the land even when it changes owners, so checking them early can save major headaches later.

Short Sale

Credit: Canva

In a short sale, a home sells for less than what’s owed on the mortgage, and the lender must sign off on it. These deals can take months to finalize and often require patience, but some buyers find valuable opportunities in that waiting game.

Underwriting Conditions

Credit: Getty Images

Even after a loan gets a preliminary green light, lenders often come back with extra requirements—more pay stubs, updated bank statements, or proof of reserves. Meeting these quickly keeps the process moving and prevents a last-minute stall right before closing day.

Quitclaim Deed

Credit: Getty Images

This document passes along whatever ownership interest someone has without making promises about the title’s condition. It’s often used within families or in divorce settlements, but buyers outside those circles typically prefer stronger protections and warranties before handing over funds.

Conditional Use Permit

Credit: Canva

Local governments sometimes allow a property use that’s not typically permitted under current zoning rules, but only with special conditions. A buyer planning to operate a home-based business or expand a structure may need to apply for a CUP before proceeding.

Wraparound Mortgage

Credit: Getty Images

This financing method layers a new loan over an existing one, thus creating a single combined payment. It can help buyers access financing when options are limited, but the structure is complex and requires careful coordination between all involved lenders.

Lis Pendens

Credit: Canva

When a lawsuit involves a property, a public notice called a lis pendens is filed. It warns potential buyers that ownership might be contested. Many steer clear of these homes until the legal issues are resolved.

Tax Lien Sale

Credit: Getty Images

If property taxes go unpaid, local governments can sell a tax lien to investors. If debts remain unpaid, buyers of these liens may eventually gain ownership, so it’s important for sellers to stay current on taxes.

Chain of Title

Credit: Getty Images

This is the documented history of a property’s ownership that shows every transfer without missing links. Title companies dig through these records to confirm no hidden claims exist. A clear chain offers peace of mind that the sale won’t spark future disputes.

Encroachment

Credit: Getty Images

Sometimes a neighbor’s fence, shed, or driveway crosses onto someone else’s land without permission. These encroachments can spark conflicts or affect a sale’s value. A proper survey flags these issues early so buyers can decide how to handle them before signing.

Redemption Period

Credit: Canva

Some states give the previous owner time after a foreclosure sale to reclaim the property by paying what’s owed. Buyers of foreclosed homes need to know these windows because a surprise redemption could undo their plans even after they think they’ve secured the deal.

Deficiency Judgment

Credit: Canva

If a home sells in foreclosure for less than the mortgage balance, some lenders can pursue the former owner for the difference. State laws vary, so buyers of distressed properties often review this history.

Alienation Clause

Credit: Getty Images

Some mortgages include a rule requiring the entire loan to be paid off if the property is sold or transferred. This prevents someone else from simply taking over the existing loan. It’s a detail worth knowing because it shapes how a future sale is handled.

Special Assessment

Credit: pexels

Condo boards or local governments sometimes impose a one-time fee to cover major repairs or improvements. Buyers who don’t ask about upcoming assessments can face unexpected bills after moving in, so a quick check with the association can be a smart step.

Underwriter’s Stipulations

Credit: Getty Images

Even at the last stage, an underwriter might ask for more evidence, like extra pay records or proof of funds. Meeting these requests quickly can make or break a closing timeline. They’re the final hoops before a lender issues full and official approval.

Plat Map

Credit: Getty Images

A plat map is a recorded map that shows property boundaries, easements, and lot dimensions in a development. Reviewing it helps buyers understand exactly what land they’re buying and what rights come with it.

Variance

Credit: iStockphoto

Local zoning rules might not fit every property plan. A variance is official permission to go outside those rules, perhaps building closer to a boundary than normally allowed. Buyers planning renovations often check if a property already depends on one.

Defeasible Fee

Credit: Canva

Some deeds grant ownership with a condition attached, like keeping the land residential. If that condition is broken, ownership can revert. Reviewing these terms carefully before purchase helps buyers avoid surprises that could limit future plans or value.