Sneaky Subscription Fees You Should Cancel Immediately

Most subscriptions aren’t kept on purpose. They start for a reason, then stay active out of habit. Small monthly charges can be easy to overlook, especially when nothing seems to be working. Here are ten common subscriptions that often remain active without delivering a significant return, which makes them some of the easiest expenses to trim right now.

Streaming Services You Signed Up for One Show

Credit: Canva

Subscribing to a single series is one of the most common ways people add unnecessary monthly costs. Once that show ends, the platform often goes untouched. Deloitte estimates that the average U.S. household pays about $69 per month on streaming, much of which is spread across rarely used services that could be canceled without affecting viewing habits.

Free Trials That Quietly Turn Paid

Credit: Getty Images

Many free trials require payment details upfront and convert to full-price plans in as little as seven days. Consumer Reports notes that even missing the cancellation window by a single day can trigger a full billing cycle, turning a “test” into an ongoing charge that offers no apparent benefit.

Cloud Storage Plans That Grew on Autopilot

Credit: iStockphoto

Automatic photo backups and file syncing quietly push accounts past their free limits, kicking in paid plans by default. Most people never revisit or adjust those settings. Over time, unused files and duplicates accumulate, resulting in users paying month after month for storage they rarely use or even think about.

Fitness Apps You Stopped Opening

Credit: Canva

Workout and meditation apps often get downloaded during bursts of motivation, then fade out just as quickly. Most people stop using them within weeks, even though the subscription keeps renewing. Paying for an app that no longer fits into your day is one of the simplest expenses to cut.

Delivery Memberships That Overlap

Credit: Canva

Food delivery and retail shipping memberships often accumulate without a clear overview of the costs. Households may hold multiple plans offering similar benefits, each charging a monthly fee that feels minor on its own. Financial planners note that order histories often show uneven usage, with some memberships resulting in only a handful of orders.

Smart Home Devices With Locked Features

Credit: Canva

Smart cameras, doorbells, and security sensors are often sold at reasonable upfront prices, but then paired with monthly fees for basic functions, such as video history or alerts. Consumer Reports has noted that many models limit playback or storage unless a subscription remains active, even when the hardware itself functions properly without cloud access.

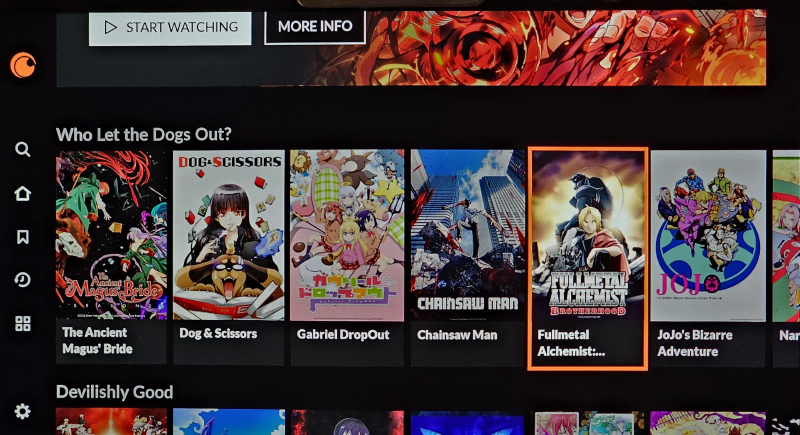

Niche Entertainment Apps You Forgot About

Credit: Reddit

Specialty streaming apps built around a single genre or interest blend into billing statements because the fees remain small. Budget analysts frequently flag them because interest fades faster than the subscription cycle does. These services often experience a burst of activity early on, followed by extended periods of inactivity.

Premium Versions Of Free Apps

Credit: iStockphoto

Many apps offer paid tiers that unlock features most users rarely touch. Surveys show that a large share of subscribers continue to pay while relying on the same basic tools they used before upgrading. The monthly charge remains justified in theory, even when daily use never changes from the free version experience.

Gym Memberships With Low Attendance

Credit: Getty Images

Fitness centers rely on consistent billing rather than consistent visits. Contracts, annual fees, and auto-renewals keep charges steady, even when workout routines shift to home, outdoors, or occasional class-based alternatives. Industry data indicate that a significant portion of members attend infrequently, especially outside of January, as New Year’s resolutions often fade.

Shopping Subscriptions With Automatic Renewals

Credit: Getty Images

Retail memberships promise convenience through shipping perks or early access, but renewal dates often pass unnoticed. Consumer finance studies show many shoppers underestimate how little they use these benefits across a year. The subscription stays mainly active because it feels familiar, not because it gets actively evaluated.