How to Handle Owing Money to Family or Friends Without Ruining the Relationship

Borrowing from people close to you can feel simple when there’s no contract or interest attached. But money can shift the tone of a relationship quickly. A favor can turn into missed calls or strained silences that weigh heavier than words. Often, the real stress comes less from the dollar amount than from trust breaking down or poor communication.

Still, family debt doesn’t have to end in conflict. With honesty and a clear plan, it’s possible to repay what you owe while holding on to the people who matter most.

Start With Clarity

Credit: Syda Productions

Acknowledge the debt clearly. Remember, money has ended friendships over less, so it’s best to say the amount out loud and confirm it together. That small step eliminates fuzzy memories and stops future arguments. Keeping the numbers clear protects both sides.

Promise Only What You Can Deliver

Credit: Getty Images

It’s tempting to agree to quick repayments when you feel the need to reassure. Don’t. A steady plan you can actually afford shows reliability in a way rushed promises never do. People value dependability over speed, and a schedule that matches your income makes it clear you’ll stick to what you said.

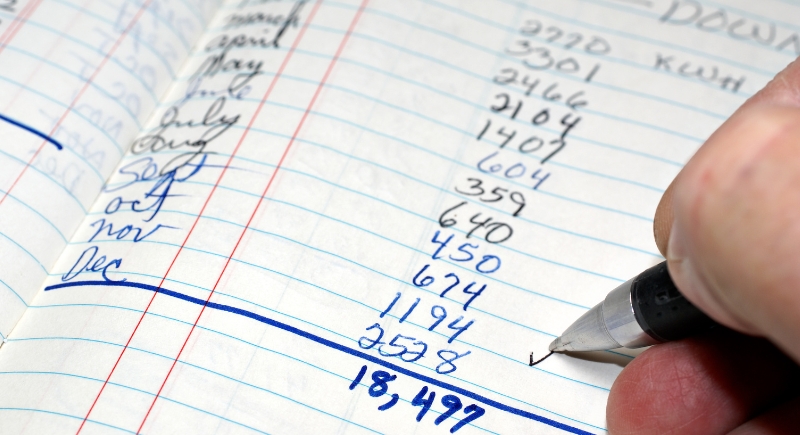

Keep a Record

Credit: Getty Images

When memories fade, text threads, emails, or even handwritten notes can be lifelines. Having something real means that you have a shared understanding instead of just going by how you feel. Documentation makes it easy to pay back and stops arguments like “you never said that,” which are harder to fix than the money itself.

Look at Formal Options First

Credit: Getty Images

Turning to a credit union loan or a payroll advance often creates less strain than borrowing from relatives. Exploring those choices first keeps personal ties clear of financial tension and leaves family support as a last resort. The fewer debts tied to close relationships, the easier it is to keep them strong.

Treat It Like Rent or Utilities

Credit: Canva

Put it in your budget with the same weight as bills. When paying back is seen as optional, people start to feel resentful. Seeing it next to real responsibilities helps keep discipline strong. You’re less likely to skip paying off your debt for fun things if you can see it in your monthly plan.

Say Something Before They Ask

Credit: Getty Images

A short message will do. Staying in touch lets them know that you haven’t forgotten about paying them back. Even if it isn’t, your silence may feel like you are avoiding something. Being proactive shows that you care about them and saves them the trouble of having to chase you.

Pay in Pieces if You Must

Credit: Getty Images

Waiting for one big payoff can delay everything. Small amounts take away from the total and send a stronger message than excuses. Even paying half of what you planned to can help ease tension and keep the lines of communication open. It always helps them trust you.

Be Honest About Setbacks

Credit: Getty Images

There are times when you have to leave your job, pay medical bills, or deal with other emergencies. Please let your lender know what’s going on before payments stop. People are more likely to forgive delays if they know why they happened.

Remember the Legal Side

Credit: Canva

Family loans don’t always stay in the family. They can be taken to court like any other public debt. Keeping that in mind makes it more likely that you will follow through on the deal. It’s better to avoid going to court than to let things get worse and end up in court.

Watch Out for Red Flags

Credit: Getty Images

Someone who says they are your “friend” but charges you interest or threatens you when you’re late might not really be your friend. Loan sharks hide behind trust. If you feel stressed, get professional help before you get stuck in a cycle that gets worse over time.

Respect Their Rules

Credit: Getty Images

If they want to be repaid on a certain schedule or with a specific method, honor it where possible. It means showing that you value their boundaries. Respecting their choices makes it easier for them to pay you back and shows that you value their comfort as much as your own.

Gratitude Goes a Long Way

Credit: Getty Images

Repaying clears the balance, but saying thanks keeps goodwill alive. A kind act, like dinner or a note, shows appreciation for the help that goes beyond money. People want to feel appreciated. Being thankful keeps the relationship personal instead of transactional and shows that you value the trust they put in you.

Don’t Double Down on Debt

Credit: Getty Images

Do not ask for more if you already owe them some. When you add more debt to loans that haven’t been paid back quickly, trust is lost. Get rid of the first loan before you think about the next one. When you borrow money again, it shows that you didn’t plan ahead.

Use Tools, Not Willpower Alone

Credit: Getty Images

Software, apps, and spreadsheets that keep track of numbers keep you honest. Making small changes, like switching phone plans, can help you save money and pay off your debt faster. Seeing progress is also helpful. Seeing the balance go down gives you energy and makes the process of becoming debt-free more realistic.

Protect Your People From Your Financial Misery

Credit: Getty Images

If you’re already juggling debt, stop leaning on your friends and family. It’s more important to protect relationships than to get quick cash. Get your money in order before you make promises you can’t keep. Knowing your limits shows discipline, not weakness, and prevents you from harming your finances or stressing loved ones.