7 Simple Steps to Boost Your Monthly Cash Flow

If the bank account looks good but your business still feels like it’s limping from bill to bill, there’s a good chance cash flow is the issue. It’s one of those hidden problems that doesn’t always appear in profit reports but can hit hard when bills come due and the cash isn’t there. The good news is that these small changes can make a big difference.

Lease What You Can

Credit: iStockphoto

Leasing often seems like a quick fix, but it helps protect your monthly cash position. You’re spreading out the cost instead of tying up a massive chunk of money in one go. That extra breathing room lets you cover operating expenses more comfortably. Plus, lease payments usually count as tax-deductible business expenses.

Offer a Discount for Fast Payment

Credit: iStockphoto

If you want customers to pay faster, give them a reason to. A small discount, like 2% if they pay within 10 days, can speed things up. It might shrink your profit a little, but it helps cash land in your account quicker, so you can cover your own obligations.

Send Invoices Immediately

Credit: iStockphoto

Time is money, especially when it comes to invoicing. The faster you send your invoice, the sooner your customer can pay. Many small businesses delay this part of the process without realizing it slows everything else down. Automating it right after job completion helps cash come in without unnecessary delays.

Use Electronic Payments for Bills

Credit: iStockphoto

Paying bills by check wastes time and money. When you switch to electronic payments, you can wait until the due date to pay without being late. This extends your cash availability without any penalties. It also helps with budgeting since you can time payments more precisely and avoid gaps in your cash flow.

Ask for Better Payment Terms

Credit: iStockphoto

Don’t be afraid to have a conversation with your suppliers. Many are open to extending payment terms if you’re a reliable customer. Even just 15 extra days can make a big difference to your month. It gives you a cushion to get paid by your clients before your bills are due.

Improve Your Inventory Flow

Credit: iStockphoto

Inventory that sits too long ties up dollars you could use somewhere else. Look at what’s not moving and stop restocking it. Instead, focus on the items that sell regularly. Offload slow movers, even at a discount, and reinvest the cash into better-selling inventory or bills that can’t wait.

Check Your Customer’s Credit First

Credit: iStockphoto

A sale only counts once you’re paid. Before giving a customer credit, check their payment history or credit rating. If they’ve had problems, they might not pay you on time either. Get paid upfront or use shorter terms for riskier clients. Protecting your cash is more important than landing every deal.

Try Raising Prices Strategically

Credit: iStockphoto

It’s not always about slashing costs—sometimes the solution is charging more. A slight increase in products or services can give your cash flow a healthy bump without affecting customer loyalty. Run a limited test, monitor the outcome, and adjust as needed.

Use a Business Credit Card With Perks

Credit: iStockphoto

Business credit cards aren’t just for emergencies. When used smartly, they offer flexibility through grace periods and sometimes even cash back. If your billing cycles are tight, this can help bridge the gap. Just don’t let the balance linger. Treat it as a buffer, not an excuse to overspend.

Set Up Auto-Pay for Recurring Expenses

Credit: iStockphoto

Recurring bills can sneak up, especially during busy periods. Automating payments for fixed monthly expenses helps avoid late fees and keeps things predictable. You’ll free up mental space and ensure your bills get paid on time. It’s one less thing to track.

Encourage Bigger Orders With Incentives

Credit: iStockphoto

Want customers to spend more per order? Give them a little push. Offering a bonus item or a discount for larger purchases helps move more product and brings in bigger chunks of cash. It’s smart to increase your incoming cash without chasing down more individual orders.

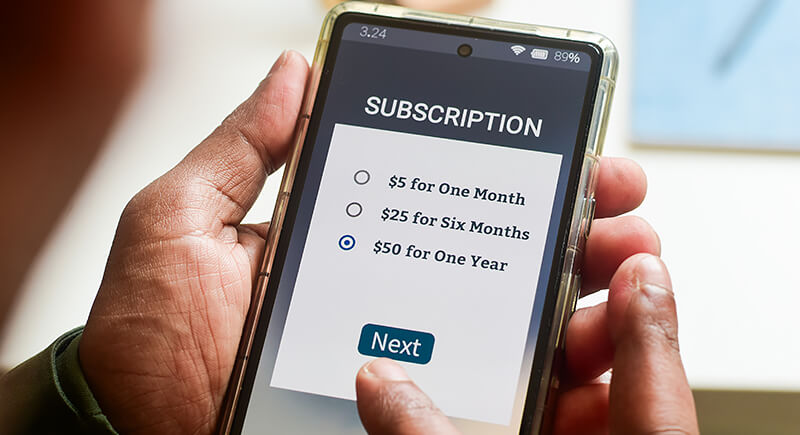

Create a Subscription Option

Credit: iStockphoto

Recurring revenue is gold for monthly cash flow. If your product or service fits the model, consider offering a subscription plan or a monthly retainer. It makes your income predictable, smooths out dry spells, and keeps loyal customers engaged. Even modest subscriptions stack up over time, adding stability to your budget.

Sell Off Unused Assets

Credit: flickr

Old equipment and extra furniture eat up space and tie up funds. Selling them clears clutter and converts forgotten assets into usable cash. Platforms like Craigslist, Facebook Marketplace, or local business groups make it easy to find buyers. That money can help cover urgent expenses or replenish inventory.

Offer Tiered Payment Plans

Credit: iStockphoto

When a client hesitates because of a hefty invoice, don’t lose the sale—offer a split-payment option. Biweekly or monthly installments make it easier for them to commit and help you keep a steady income flowing in. It also builds trust and often improves the chances of getting paid in full on time.

Join a Buying Group

Credit: iStockphoto

Pooling your purchases with other businesses can mean serious savings. Buying groups allow small operations to access bulk pricing usually reserved for big companies. You’ll cut costs on packaging, supplies, and raw materials. That monthly savings goes straight to your cash reserves instead of disappearing into vendor invoices.