10 of the Biggest Financial Fraud Cases in Recent History

Financial fraud has become part of everyday news. Most cases involve small, personal losses such as a hacked account or a fake investment. But some frauds are far larger. These schemes unfolded inside major companies, during investor calls, on trading floors, and in boardrooms. Billions of dollars changed hands in plain sight, prompting industries to question how such deception had gone unnoticed.

Enron

Credit: Wikimedia Commons

For years, Enron felt untouchable. Analysts praised it. Politicians admired it. Business schools used it as a model. Behind the scenes, debt was pushed into special entities designed to stay off the books. Profits looked strong while risk kept piling up elsewhere. When the illusion collapsed in 2001, approximately $74 billion in shareholder value vanished, along with jobs and pensions.

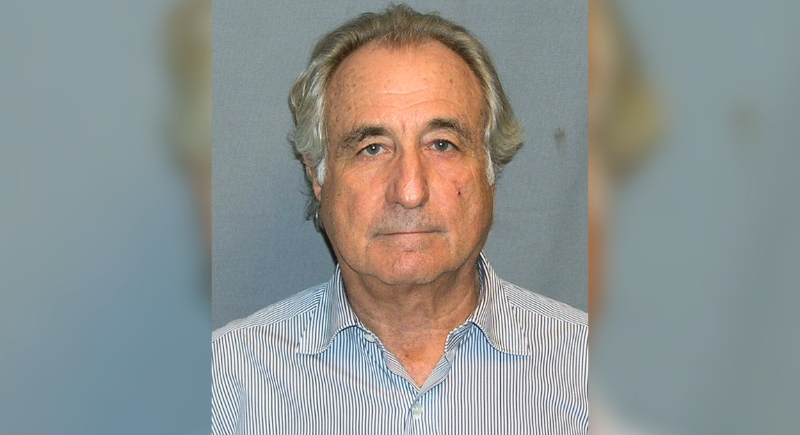

Bernie Madoff

Credit: Wikimedia Commons

This fraud was successful because it seemed uninteresting. Madoff promised steady, predictable returns. Investors trusted the paperwork and the reputation. There were no real trades, only money recycled from new clients. When withdrawals surged during the 2008 crisis, the scheme collapsed instantly. The damage reached charities, pension funds, and families worldwide, totaling roughly $65 billion in fake account balances.

Wirecard

Credit: Wikimedia Commons

Wirecard was treated like proof that Germany could produce a global tech champion. It even joined the DAX index. Then, auditors discovered something basic was missing: €1.9 billion in cash that supposedly sat in overseas accounts. It never existed. Years of forged records and missed warnings ended in a sudden collapse, forcing Germany to rethink how closely it monitors corporate reporting.

WorldCom

Credit: Facebook

WorldCom simply mislabeled everyday expenses as long-term investments. That one decision made profits look far better than they actually were. Between 1999 and 2002, more than $11 billion in costs were hidden in this manner. When regulators caught on, the company fell fast, wiping out jobs and reshaping expectations around executive responsibility.

Theranos

Credit: Wikimedia Commons

The company promised blood testing that required only a few drops and delivered faster results at a lower cost. That pitch attracted investors and heavy media attention early on. Internally, the machines failed repeatedly and produced unreliable results, but those problems were not disclosed. Around $700 million was raised before regulators stepped in, and the company collapsed once the claims could no longer be defended.

FTX

Credit: Youtube

FTX grew at breakneck speed, driven by trust in a young founder and lax oversight in the crypto markets. Customer funds were funneled into risky bets through a related hedge fund. When confidence cracked in 2022, everything unraveled within days. Billions disappeared. Sam Bankman-Fried later received a 25-year prison sentence as recovery efforts began for affected users.

Lehman Brothers

Credit: Wikimedia Commons

In the months leading up to its failure, Lehman employed a tactic known as Repo 105. It temporarily shifted massive debts off its balance sheet just long enough to appear healthier on paper. Roughly $50 billion in liabilities were obscured this way. When Lehman collapsed in 2008, it sent shockwaves through global markets and helped deepen the financial crisis.

Barings Bank

Credit: Facebook

This collapse can be traced back to a single trader and almost no oversight. Unauthorized derivatives trades were hidden through falsified records, while losses grew unchecked. By 1995, the damage reached £827 million. Britain’s oldest merchant bank folded almost overnight. The case is still taught today as a reminder that even long-standing institutions can fall when internal controls fail.

1MDB

Credit: Wikimedia Commons

What began as a national development fund turned into a global money trail. Investigators later traced approximately $4.5 billion that was siphoned through shell companies and offshore accounts. The money was used to fund luxury properties, art, yachts, and entertainment across several countries. Banks, politicians, and intermediaries were drawn into the fallout, making it one of the most complex fraud investigations ever handled.

Luckin Coffee

Credit: Wikimedia Commons

Between 2017 and 2020, Luckin Coffee fabricated about $310 million in sales to inflate its revenue. The false figures supported rapid expansion and a successful U.S. IPO. When the fraud was uncovered, the stock collapsed and the company was delisted from NASDAQ. Regulators in both China and the United States later increased scrutiny of overseas-listed firms.