The 10 Best Companies to Invest in Now, according to Analysts

Analysts follow a wide range of companies, but a few consistently appear in their reports because the fundamentals appear steady and the direction makes sense. These aren’t buzzy picks. They’re businesses that have adapted well, hold real advantages, or continue to meet demand in ways that stand out. The list highlights ten companies that analysts say are worth watching for their own distinct reasons.

Campbell’s

Credit: Wikimedia Commons

Campbell’s ongoing cost-cutting plan is changing how effectively it moves products through its supply chain. Its core grocery staples continue to sell well, especially in moments when shoppers lean toward familiar choices. The multiyear savings effort gives the company some financial room to work with, and the stock is trading below several analysts’ valuation targets.

Constellation Brands

Credit: pexels

Modelo and Corona maintain their lead in the premium import category, and demand in this segment rarely experiences significant declines. New beverage concepts arrive frequently, providing retailers with a solid rotation on their shelves. Distribution leverage remains a meaningful advantage. Analysts flag the gap between its trading price and intrinsic value estimates as an appealing entry point.

BAE Systems

Credit: Wikimedia Commons

Defense spending commitments across Europe and the United States lock in predictable revenue for BAE’s aviation and cybersecurity divisions. Backlogs tied to multiyear agreements offer unusual stability in a volatile market year. Analysts reviewing contract depth see continued strength in future cash flow, and the company’s shares trade at a level considered discounted.

Yum China

Credit: Wikimedia Commons

China’s growing preference for quick, convenient meals gives Yum China room to keep expanding KFC and Pizza Hut. Urban growth patterns support that strategy, and digital ordering helps maintain steady traffic. Even with occasional economic slowdowns, the stock remains well below several fair-value estimates.

Chipotle Mexican Grill

Credit: Wikimedia Commons

Chipotle’s digital ecosystem plays a significant role in its growth, with more than 40 million loyalty members returning often enough to maintain strong sales momentum. The company keeps adding new locations across the country, and that reinforces its place in the fast-casual sector. Morningstar’s valuation indicates that the stock is trading approximately 26 percent below its fair value, which suggests significant long-term appeal.

Ambev

Credit: Wikimedia Commons

Beer consumption trends across Latin America continue to shift toward brands that Ambev controls, which gives the company significant pricing flexibility. Its distribution network reaches remote markets that competitors struggle to serve. Analysts studying cost advantages see durable profitability in multiple regions. The stock’s current level sits meaningfully lower than several independent valuation estimates.

Clorox

Credit: Wikimedia Commons

A steady market for cleaning and household items gives this company a dependable footing, even when budgets tighten. Growth in e-commerce helped it reach shoppers who prefer avoiding store aisles, strengthening its overall reach. Long-running investments in product updates and efficiency support its position in the category. Shares currently trade well below commonly cited fair value estimates.

Tyler Technologies

Credit: Facebook

City and county governments rely on Tyler’s software to manage courts, taxes, and public safety. Once adopted, these systems typically remain in place for extended periods, generating dependable revenue. Cloud migration projects add new subscription layers. Published research notes that the stock trades below its projected worth despite its strong position in government technology.

Bristol Myers Squibb

Credit: Facebook

A refreshed lineup of oncology and immunology treatments is beginning to offset the impact of older drugs approaching patent expiration. Recent acquisitions strengthened the pipeline, and collaborative projects reduce research risk. Analysts tracking clinical progress identify a solid foundation for the next few years. The stock’s discount to target prices has kept institutional interest steady.

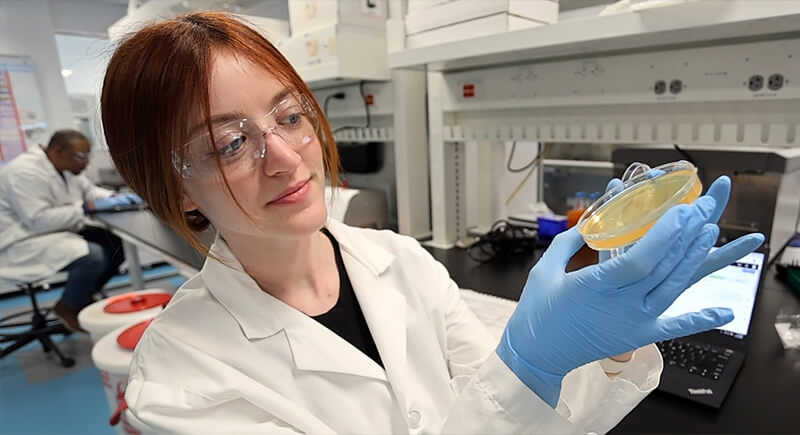

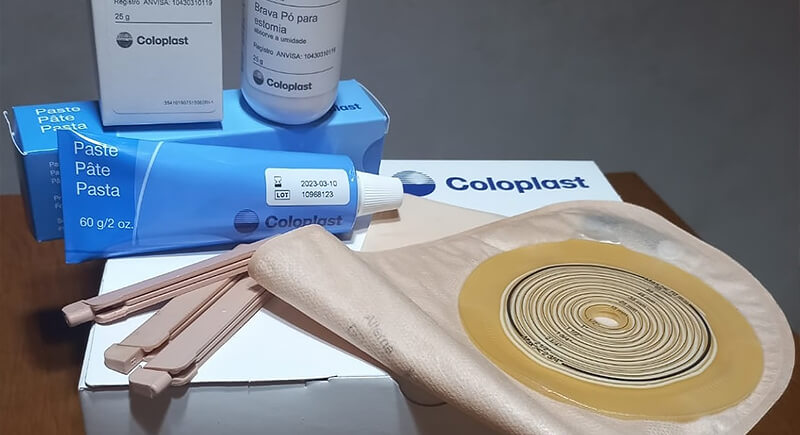

Coloplast

Credit: Wikimedia Commons

A long stretch of steady product development has shaped Coloplast’s place in global ostomy and continence care. Cost discipline since 2008 has improved profitability, and the company now leans toward expansion into additional markets, with the United States becoming a larger focus in its growth plans.