10 Easy Money Moves That Take an Hour or Less to Complete

An hour doesn’t feel like much anymore as it disappears into errands, notifications, or half-watched shows. However, there are a few financial tasks that fit neatly into that window and continue to work long after the hour is over. These are some small moves that clean up loose ends, reduce risk, or put idle money to better use.

Put Idle Cash Into a High-Interest Savings Account

Credit: Getty Images

Cash that isn’t doing anything still feels productive because it’s “safe.” But when inflation outpaces your savings rate, safety comes with a cost. High-interest savings accounts in the U.S. are currently paying around 4 percent APY, and transferring money between accounts typically takes just minutes. Ten thousand dollars at that rate earns roughly 400 dollars a year while staying liquid and accessible.

Scan Credit Reports for Costly Errors

Credit: Getty Images

Credit reports influence loan terms, insurance pricing, and background checks, often without much visibility into their impact. Consumer Reports found that 44 percent of reviewed credit reports contained at least one error. Accessing reports through AnnualCreditReport.com is free and takes minutes. Late payments listed incorrectly or unfamiliar accounts are common issues that can be disputed online.

Freeze Credit to Block Fraud

Credit: Getty Images

Most financial safeguards are reactive, but a credit freeze flips that. Once it’s in place, new accounts can’t be opened without your approval, even if your information leaks in a data breach. It’s free, takes about 10 minutes per bureau, and can be temporarily lifted when needed.

Cancel Subscriptions That No Longer Earn Their Keep

Credit: DragonImages

Subscriptions rarely feel expensive because they don’t arrive all at once. They drip out monthly and blend into routine expenses. Surveys show that people consistently underestimate the number of subscriptions they’re paying for. One focused review of bank and card statements often reveals services that had become useless long before they stopped billing.

Automate Bills to Reduce Mental Load

Credit: DragonImages

Late fees and interest charges often come from missed due dates rather than a lack of funds. Autopay turns fixed expenses into background processes rather than recurring tasks you might forget. Once it’s set, utilities, cards, and loans stop competing for attention, which is often the most limited resource in personal finance.

Shop Auto Insurance Before Renewal Hits

Credit: Canva

Auto insurance prices shift more quickly, often without notice until the renewal email arrives. In 2025, rates climbed sharply in many states, according to Consumer Price Index data. Running fresh quotes takes minutes and uses information you already have. Coverage details matter more than brand names when comparing options side by side.

Use a Balance Transfer Card Strategically

Credit: Canva

Credit card interest compounds daily, so timing matters. Balance transfer cards sometimes offer zero percent APR periods lasting up to 18 months, depending on credit profile. Applications are usually completed online, with transfer fees disclosed upfront. Large balances reveal the impact fastest, especially when payments shift away from interest and toward principal.

Search for Money Already in Your Name

Credit: Getty Images

Most people have unclaimed funds with state agencies after their accounts go dormant or checks remain uncashed. The National Association of Unclaimed Property Administrators estimates millions of people are listed in these databases. Searches are free and take minutes, and old payroll checks, insurance payouts, and forgotten accounts appear more often than expected.

Negotiate a Lower Cell Phone Bill

Credit: pexels

Wireless pricing allows for adjustments, especially on older plans. Data from Doxo shows that the average monthly bill has exceeded $120 in recent years. Calling customer retention departments midweek often yields options that are not available online. Your usage patterns, unused data, and promotional plans hold the key to what will be offered during those conversations.

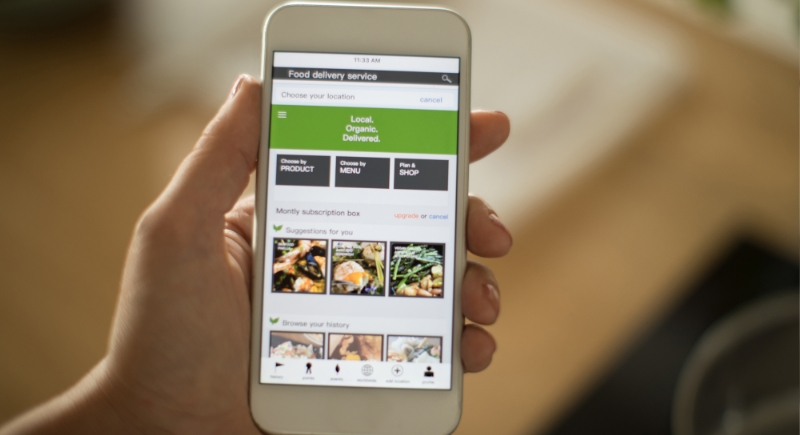

Let Grocery Apps Do the Saving

Credit: Getty Images

Store apps now control most pricing behind the scenes, as loyalty discounts, digital coupons, and personalized offers are applied automatically once accounts are set up. RetailMeNot reports that frequent users save hundreds of dollars annually without changing what they buy. Receipt-scanning apps add another layer after checkout, tying savings to routine shopping rather than to planning sessions.